This week's roundup:

- In Focus: What to Watch for in Medicare Advantage Policy this Fall

- Colorado Announces Behavioral Health ASO Awards

- Kansas Judge Denies Aetna’s Petition for Judicial Review Over KanCare Awards

- Michigan Announces Award Recommendations for MI Coordinated Health HIDE SNP

- New York School-based Providers to Transition Medicaid Payments to Managed Care in April 2025

- Texas Pauses Medicaid STAR, CHIP Contract Awards

- CMS Releases Medicare $2 Drug List Model RFI

- CMS Releases Final Guidance for Second Cycle of Medicare Drug Price Negotiations

- CMS Issues Revised IPPS Policy to Reduce Low Wage Hospitals Payments in Fiscal 2025

- UnitedHealthcare Sues CMS Over Medicare Advantage Star Rating

- MTM Completes Acquisition of Access2Care

- Elevance Acquires Kroger’s Specialty Pharmacy Business

- More News Here

In Focus

What to Watch for in Medicare Advantage Policy this Fall

This week, our In Focus section previews key public policy issues affecting Medicare Advantage (MA) and Medicare Part D that could potentially be addressed under regulations issued by the Centers for Medicare & Medicaid Services (CMS) later this fall. CMS’s highly anticipated regulations—which include annual programmatic, policy, and technical updates to the MA and Part D programs for the coming plan year—are under review at the Office of Management and Budget and are expected to be released in the coming weeks ahead.

In addition to the proposed rule, healthcare organizations are closely tracking CMS regulations that are expected to be released later this year, which would impact MA plan payment rates as well as proposed regulations intended to streamline the prior authorization process for prescription drug coverage under Medicare. This annual regulatory policymaking process is getting under way as the Medicare Open Enrollment period begins October 15, 2024, during which Medicare beneficiaries will compare Medicare health plan and drug coverage options and select the coverage that best meets their health care needs. (See Table 1 for key 2024 MA dates.)

As the last major Medicare policy regulations from the Biden Administration, healthcare entities can expect a continued focus on regulatory policies and requirements that strengthen program oversight and enhance beneficiary protections, while also seeking to maintain stability in Medicare benefits offerings and plan choices.

Following are some of the key issues to watch for as CMS’s annual regulatory process begins this fall.

Health Equity

Ensuring health equity is a foundational element of CMS’s strategic plan and the agency seeks to advance health equity goals and improvements across all of its programs, including Medicare Advantage. Beginning next year, MA plans will be required to conduct an annual review and analysis of utilization management (UM) policies and procedures from a health equity perspective. By requiring public reporting and identifying any impacts on underserved populations, this requirement is designed to ensure MA plans’ UM policies and procedures ensure access to medically necessary care, especially for vulnerable, low-income populations, such as beneficiaries who receive the Part D low-income subsidy and those who are dually eligible for Medicare and Medicaid.

In addition, CMS has finalized rules to collect health equity data, including race and ethnicity data, and adopted changes to the MA quality measurement program that will provide incentives for MA plans to improve care for underserved and vulnerable populations, including beneficiaries with high social risk factors.

Stakeholders should expect CMS to continue building and strengthening policies to advance health equity goals while exploring new initiatives to reduce disparities and close gaps in care for vulnerable populations.

Consumer Protection and Oversight

Earlier this year, CMS launched a high-profile effort to increase transparency in Medicare Advantage, including the release of a request for information (RFI) to solicit public input on ways to improve data collection and enhance oversight over all aspects of the MA program. Details are posted here. In addition to seeking comments on improving overall MA data collection and public reporting, the CMS RFI on MA data collection solicited specific recommendations to improve data collection and accountability for MA plans’ provider networks and prior authorization process.

While the formal comment period closed in May 2024, responses to the CMS RFI on MA data collection can inform and shape future regulatory policy direction, as CMS continues to examine ways to improve transparency and oversight over MA plans.

Quality and Star Ratings

CMS will soon release the Medicare Advantage Star Ratings, which measure the quality of MA plans based on a range of quality and performance metrics. The Star Rating system provides beneficiaries with crucial information to compare plans and select the coverage option that best meets their needs. High-performing plans receive bonuses—which provides incentives for plans to continue to improve quality of care for beneficiaries and patient outcomes. Last year, MA plans received $11.8 billion in bonus payments, and 74 percent of MA beneficiaries were enrolled in plans that achieved a rating of four or more stars. Details are available here.

On the regulatory front, CMS recently adopted significant changes to Star Ratings that continue to have far-reaching impacts on MA plans’ quality performance, which, in turn, will continue to shape and inform their quality improvement strategies. Among the notable regulatory changes CMS has adopted is the new Health Equity Index, which rewards MA plans that provide high quality care to beneficiaries with social risk factors, including low-income beneficiaries and those dually eligible for Medicare and Medicaid. Though this policy change takes effect in 2027, MA plans can take steps now to prepare and enhance their capabilities to improve quality of care for beneficiaries with social risk factors, including using targeted care coordination programs.

As policymakers and stakeholders continue to monitor the impact of recently finalized changes to MA Star Ratings, CMS will continue exploring improvements to the MA Star Ratings system that further raise the bar on quality and ensure the program aligns with CMS’s broader goals and objectives.

Prior Authorization

As MA plans have increased the use of prior authorization and drawn scrutiny among patient advocates and providers, CMS has taken important steps to streamline and improve the prior authorization process to ensure timely access to care for Medicare beneficiaries. These regulatory policy changes—which include continuity of care requirements beneficiaries, increased oversight over UM practices, and ensuing evidence-based clinical decisions within MA are consistent with traditional fee-for-service (FFS) Medicare—are intended to ensure prior authorization and other UM tools do not create barriers to medically necessary care for Medicare beneficiaries.

Policymakers continue to look for ways to further improve the prior authorization process, and CMS has signaled additional interest in further regulatory standards to strengthen oversight and improve beneficiary protections. Potential policy options CMS could pursue include requiring more detailed reporting by MA plans (including number of prior authorization requests, denials, and appeals by type of service), extending prior authorization standards and consumer protections to prescription drugs covered by Medicare, and improving the timeliness of prior authorization decisions to avoid delays in necessary care.

Risk Adjustment Payment Policy and Coding

CMS has adopted significant changes to the MA risk-adjustment model, which continue to be phased in over a three-year period (2024−2026). These changes include important technical changes to improve the model’s payment accuracy, including a focus on conditions that are subject to more coding variation. Because CMS risk-adjustment changes will be fully implemented by calendar year 2026, policymakers and stakeholders are closely monitoring whether CMS will pursue additional regulatory policies to improve the accuracy of the risk adjustment program and address coding issues.

Since 2018, CMS—as required by statute—has applied a coding intensity adjustment that reduces MA risk scores by 5.9 percent annually to ensure consistency with Medicare FFS coding. However, MedPAC and others have continued to raise concerns that MA risk scores are higher than those for similar Medicare FFS beneficiaries, even after accounting for the 5.9 reduction in MA risk scores, which results in increased payments to MA plans. As policymakers continue to evaluate changes to ensure the long-term sustainability of the Medicare program, CMS could consider further changes in this area to equalize payments between MA and FFS Medicare through risk adjustment or coding changes.

Table 1. Key 2024 Medicare Advantage Dates

| Date | Event |

| September 2024 | CMS announces average premiums, benefits, and plan choices for MA and Medicare Part D for 2025. |

| Early-to-mid October 2024 | CMS releases MA and Part D plan Star Ratings 2025. |

| October 15, 2024 | Medicare Annual Election Period begins. Medicare beneficiaries can enroll in MA or Part D plans for CY 2025. |

| October or November 2024 | CMS CY 2026 Policy and Technical Changes to MA and Medicare Part D (CMS-4208). |

| November 2024 | CMS Interoperability Standards and Prior Authorization for Drugs (CMS-0062). |

| December 7, 2024 | End of Annual Election Period. |

Next Steps

The imminent release of CMS regulations come at a critical time for the Medicare Advantage program, which continues to experience enrollment growth amid a challenging and ever-changing regulatory environment. MA plans and other stakeholders need to be prepared to engage in the formal notice and comment process as well as offer policy solutions and best practices to strengthen and enhance the program for the 33 million beneficiaries it serves.

The Health Management Associates, Inc. (HMA), team will continue to closely monitor the timing of the release of CMS regulations and will analyze the impact of the key provisions once these rules are released. We have the depth, experience, and subject matter expertise to assist organizations engaging in the rulemaking process and assessing their impact. HMA can also assist with tailored analysis and modeling capabilities to assess the policy impacts across the multiple rules and guidance.

If you have any questions about the forthcoming CMS regulations and potential impact on MA plans, providers, and beneficiaries, contact Amy Bassano ([email protected]), Julie Faulhaber ([email protected]), Andrea Maresca ([email protected]), or Greg Gierer ([email protected]).

HMA Roundup

California

California Announces Settlement Agreement with L.A. Care Health Plan. The California Department of Health Care Services (DHCS) announced on October 8, 2024, that it has reached a settlement agreement with L.A. Care Health Plan related to a 2022 case involving L.A. Care’s self-reported issues with processes for administering treatment authorizations and with member appeals and grievances. The settlement is for $55 million, $20 million of which will go to DHCS and $35 million to the Department of Managed Health Care. L.A. Care will be required to make operational improvements to ensure its 2.5 million beneficiaries receive timely access to medically necessary health care services. Of the total settlement, $28 million will go towards programs looking to improve health equity and behavioral health in Los Angeles County and support California Advancing and Innovating Medi-Cal (CalAIM). The health plan will also have to make improvements to its oversight practices of contracted entities and work with outside consultants to develop and monitor the plan’s overall improvement plan.

Colorado

Colorado Announces Behavioral Health ASO Awards. The Colorado Behavioral Health Administration (BHA) announced on October 2, 2024, its intent to award Rocky Mountain Health Plans and Signal Behavioral Health Network with contracts to serve as Behavioral Health Administrative Service Organizations (BHASOs). Rocky Mountain will operate in Region 1 and Signal will operate in Regions 2, 3, and 4. BHASOs will provide behavioral health services for each of the regions, which align with Colorado’s Medicaid Accountable Care Collaborative Phase III regional map. The contracts will initially run for a six-month period from January 1, 2025, to June 30, 2025, with five one-year renewals. BHASOs will begin providing services on July 1, 2025. BHA will work with the BHASOs to establish, administer, and maintain regional networks of behavioral health care providers and implement community-based initiatives to improve care coordination, quality, and access. The awards are subject to protest until October 15.

Indiana

Indiana Releases Findings from PBM Spending Audit. The Indiana Capital Chronicle reported on October 9, 2024, that the state’s Office of the Attorney General released an audit conducted by RxConnection LLC outlining pharmacy benefit manager spending between fiscal years 2017 to 2022. The audit found that the state’s major PBMs filed over 63 million claims during that time period, with PBMs receiving nearly $6.7 billion in payments for state-sponsored plans, including Medicaid. The audit also found financial performance issues for most PBMs in the state, as many did not meet or exceed contractual obligations. The report highlighted recommendations for improving PBM oversight and lowering spending, including continued financial monitoring and audits of PBMs by the Attorney General, prohibiting offsetting language from PBM contracts to prevent underpayments when contractual obligations are not met, and prohibiting steering language in contracts to encourage a competitive market.

Kansas

Kansas Judge Denies Aetna’s Petition for Judicial Review Over KanCare Awards. CJ Online reported on October 3, 2024, that Kansas Judge Thomas Luedke denied Aetna’s petition for judicial review of the KanCare Medicaid capitated managed care contract awards. The judge ruled that the state’s actions were not unreasonable, arbitrary, or capricious, as Aetna claimed. The lawsuit was filed after the state denied protests from Aetna and CareSource. Kansas will move forward with contracts with incumbents Centene/Sunflower Health Plan and UnitedHealthcare, and non-incumbent Elevance/Healthy Blue, slated to begin January 1, 2025.

Michigan

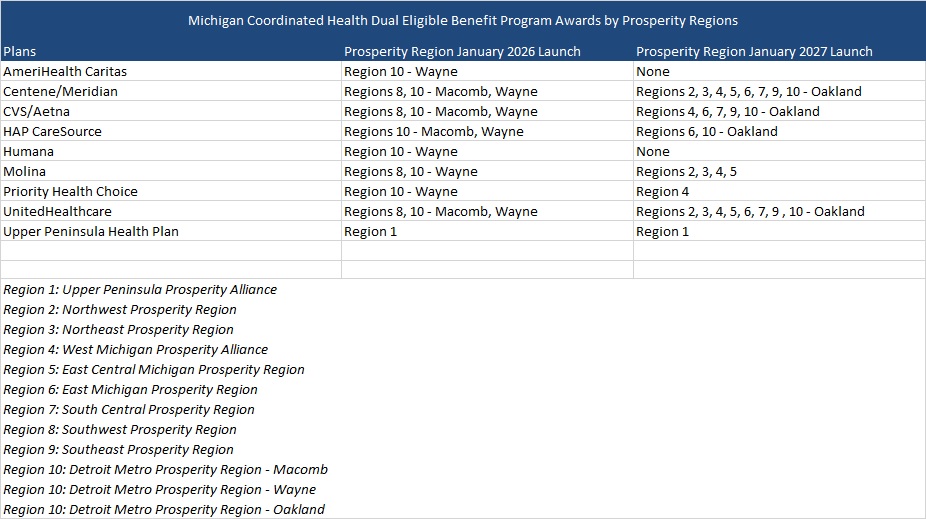

Michigan Announces Award Recommendations for MI Coordinated Health HIDE SNP. The Michigan Department of Health and Humans Services (MDHHS) reported on October 9, 2024, that it has announced award recommendations to nine health plans for the MI Coordinated Health program, the state’s new Highly Integrated Dual Eligible Special Needs Plan (HIDE SNP), launching January 1, 2026. Awarded plans include incumbents CVS/Aetna, AmeriHealth Caritas, HAP/CareSource, Centene/Meridian Health Plan, Molina, and Upper Peninsula Health Plan, and non-incumbents: Humana, Priority Health Choice, UnitedHealthcare. Plans were awarded by region. The program succeeds the current MI Health Link financial alignment initiative dual demonstration set to end December 31, 2025. The HIDE-SNP will integrate long-term service and supports (LTSS) and contracted managed care plans will provide all Medicare and most Medicaid covered benefits for their dual-eligible enrollees through capitated, D-SNP only contracts. Specialty Medicaid behavioral health services will remain carved out and will continue to be provided by Regional Pre-Paid Inpatient Health Plans (PIHPs). Current MI Health Link enrollees will have the option of moving into MI Coordinated Health with no break in coverage. MI Coordinated Health program will be available to dual eligibles in select counties in 2026 before expanding statewide in 2027. The contracts, which will serve 35,000 dual eligibles, will run for seven-years and include three, one-year optional extensions.

Michigan Awards Digital Incentives Program Contract to CHESS Health. The Michigan Department of Health & Human Services (MDHHS) announced on October 9, 2024, that it has awarded CHESS Health a contract to provide an automated incentive manager solution as part of the state’s Recovery Incentives Pilot. The pilot, which is set to launch in January 2025 and run through December 2026, will offer evidence-based treatment and motivational incentives to eligible Medicaid and Healthy Michigan Plan beneficiaries living with a substance use disorder. Providers will have access to the digital incentive management tool to streamline the delivery of incentives to beneficiaries who meet their treatment goals through the pilot.

Michigan Proposes Medicaid Policy Updates for Doula Services. The Michigan Department of Health and Human Services (MDHHS) released on September 26, 2024, proposed Medicaid policy updates for doula services. The policy would increase the number of covered doula visits to 12 per pregnancy, raising reimbursement rates to $1,500 for labor and delivery support and $100 per prenatal and postpartum visit. Additionally, beneficiaries may qualify for up to six extra visits if more support is needed. Public comments will be accepted through October 31. If enacted, the policy would be effective retroactively to October 1.

New Jersey

Ophelia to Provide Opioid Addiction Treatment for Medicaid Enrollees in New Jersey. Ophelia, a virtual opioid addiction treatment provider, announced on October 2, 2024, that it is now serving Medicaid patients statewide in New Jersey to provide medications for opioid use disorder. Ophelia will contract with Medicaid managed care plans, including Horizon Blue Cross Blue Shield, UnitedHealthcare, and Elevance/Wellpoint.

New York

New York Advances Medicaid MCO Tax Law. Crain’s New York Business reported on October 9, 2024, that the New York Department of Health submitted a federal provider tax waiver to the Centers for Medicare & Medicaid Services (CMS) last month, requesting that the agency allow New York to impose a tax on managed care organizations (MCOs) to help the state generate additional federal matching funds for its Medicaid program. CMS approved a similar waiver in California through 2026.

New York School-based Providers to Transition Medicaid Payments to Managed Care in April 2025. Crain’s New York reported on October 8, 2024, that more than 250 New York school-based health clinics will shift Medicaid payments to managed care by April 1, 2025. School health centers, which are satellite clinics linked to hospitals and other health care facilities, will be required to contract with private health insurers. The clinics claim the transition could cause payment delays, denials, and rate decreases jeopardizing operations, affecting the 250,000 students they serve. Providers will need to get certified, negotiate contracts, and hire administrative staff within a six month transition period.

New York Receives Federal Approval for New Essential Plan Subsidies in 2025. The Centers for Medicare & Medicaid Services (CMS) announced on September 25, 2024, that it has approved New York’s amendment to the Section 1332 State Innovation Demonstration, which will expand the Essential Plan to include new cost-sharing subsidies for certain Marketplace enrollees. The amended waiver will include three new state cost-sharing subsidies beginning in 2025 for only Marketplace silver plan enrollees with estimated household incomes up to 400 percent of the federal poverty level; certain diabetes-related services for all Marketplace enrollees; and for certain pregnancy and postpartum outpatient care, inclusive of mental health services, for all Marketplace enrollees. The demonstration will be effective from January 1, 2025, through December 31, 2028.

Governor Signs Legislation to Expand Health Coverage for Pregnant Women. Crain’s New York reported on October 3, 2024, that New York Governor Kathy Hochul signed a bill to expand health insurance coverage for pregnant women. Health insurance plans must now enroll pregnant people without charging fees for special enrollment related to pregnancy and allow pregnant people to enroll in policies at any time during the year without the risk of incurring a penalty.

Oregon

Oregon to Add 465 Behavioral Health Residential Treatment Beds by December 2026. The Oregon Health Authority announced on October 9, 2024, that it has launched a behavioral health housing and residential treatment capacity dashboard which tracks the state’s progress towards increasing treatment beds and recovery housing units. Oregon has a projected goal of adding 465 beds by December 2026. The dashboard includes existing capacity, added capacity based on existing provider contracts, and projected capacity based on contracts in development across bed types. Findings from a behavioral health residential study will guide the allocation of awards in the future biennium to ensure investments go to areas with the most significant need, although allocations in the dashboard are not reflective of the study results.

Texas

Texas Pauses Medicaid STAR, CHIP Contract Awards. Health Payer Specialist reported on October 7, 2024, that a judge has issued a temporary injunction against the Texas Health and Human Services Commission (HHSC), ordering the agency to pause finalization of the state’s Medicaid STAR and Children’s Health Insurance Plan (CHIP) contracts after several incumbents were not chosen to continue on as health plans. HHSC was sued in June over the awards by Cook Children’s Health Plan, Texas Children’s Health Plan, Centene/Superior HealthPlan and Elevance/WellPoint. The judge’s ruling argued that switching so many children to different plans would pose significant harm and confusion to millions of beneficiaries. A hearing will be held on November 3, 2024, to determine if the injunction will be permanent.

Texas AG Files Lawsuit Against PBMs, Pharmaceutical Companies Over Insulin Prices. Modern Healthcare reported on October 4, 2024, that Texas Attorney General Ken Paxton filed a lawsuit against multiple pharmacy benefit managers (PBMs) and pharmaceutical manufacturers over insulin drug pricing. The lawsuit alleges that the insulin manufacturers were not transparent with their drug pricing and held a monopoly on insulin manufacturing in the state, with a few PBMs controlling up to 80 percent of the market in Texas. The lawsuit claims that this allowed the PBMs and drug manufacturers to raise insulin prices by up to 1,000 percent. Companies named in the suit include Eli Lilly, CVS Pharmacy, Express Scripts, Novo Nordisk, Sanofi-Aventis, Evernorth Health, CVS Caremark, UnitedHealth Group, OptumRx, and others.

Washington

Washington Waitlists 8,000 Undocumented Immigrants for Apple Health Coverage. KOUW reported on October 7, 2024, that nearly 8,000 eligible undocumented individuals in Washington are on a waitlist for the state’s Medicaid managed care coverage Apple Health. The state expanded coverage for undocumented adults with incomes below 138 percent of the poverty line; however, the program has a budget cap of $76.8 million, with only the first 12,000 eligible applicants receiving coverage.

National

CMS Releases Medicare $2 Drug List Model RFI. The Centers for Medicare & Medicaid Services (CMS) released on October 9, 2024, a request for information (RFI) seeking feedback on its proposed Medicare $2 Drug List Model, which would create a list of generic prescription drugs that have a fixed $2 copay for Medicare beneficiaries enrolled in a Part D drug plan. CMS also released a preliminary list of drugs it intends to include as part of the model which treat common chronic conditions. The model was developed to test if a simple approach to offering low-cost drugs for common conditions can improve medication adherence and health outcomes. The RFI will be open to public comments through December 9, 2024.

CMS Releases Final Guidance for Second Cycle of Medicare Drug Price Negotiations. The Centers for Medicare & Medicaid Services (CMS) released on October 2, 2024, final guidance for the second round of Medicare Part D price negotiations. The final guidance outlines how participating drug companies must ensure eligible individuals will have access to the negotiated prices for 2026 and 2027, including procedures that apply to participating drug companies, Medicare Part D plans, pharmacies, mail order services, and other entities. CMS will announce which additional 15 drugs it has selected for negotiation by February 1, 2025, and negotiated prices will be effective starting January 1, 2027.

Vice President Harris Announces Medicare Home Care Proposal. The New York Times reported on October 8, 2024, that Vice President Kamala Harris announced a proposal to cover home health aide visits and other home care services for Medicare beneficiaries as part of Harris’ presidential campaign. The proposal aims to keep more people at home as they age rather than moving them into skilled nursing facilities. The proposal does not include specific cost estimates, but funding for the service expansion would come from savings earned through further Medicare drug price negotiations.

CMS Issues Proposed Rule on Updated Marketplace Regulations. Modern Healthcare reported on October 4, 2024, that the Centers for Medicare & Medicaid Services released the 2026 Notice of Benefit and Payment Parameters, a proposed rule looking to update regulations for the federal Marketplace Exchange. Proposed changes include strengthening oversight of Marketplace agents and brokers to prevent fraudulent actions, and requiring health plans to keep coverage for beneficiaries who have fallen behind on paying premiums if they owe under a certain amount. It also would require audits of state Marketplaces that use the federal enrollment platform to be posted publicly and increase the user fee to 2.5 percent of premiums on the federal exchange and to 2 percent on state exchanges that use the federal enrollment platform. Public comments on the proposed changes will be accepted until November 12.

CMS Issues Revised IPPS Policy to Reduce Low Wage Hospitals Payments in Fiscal 2025. Fierce Healthcare announced reported on October 2, 2024, that the Centers for Medicare & Medicaid Services (CMS) released an interim final rule to revise Medicare wage index values outlined in the fiscal 2025 Inpatient Prospective Payment System (IPPS) final rule. The revised policy recalculates the IPPS hospital wage index without the low wage index hospital policy for fiscal 2025 and the low wage index budget neutrality factor from the fiscal 2025 standardized amounts. CMS announced the policy to comply with the decision by the Court of Appeals for the D.C. Circuit that the federal agency did not have authority to implement the low wage index policy. Public comments will be accepted through November 29.

CMS Issues Final Rule to Address SAHS Billing Activity with ACOs. The Centers for Medicare & Medicaid Services (CMS) released on September 24, 2024, a final rule on mitigating the impact of significant, anomalous, and highly suspect (SAHS) billing activity on Medicare Shared Savings Program financial calculations in calendar year 2023. The rule is part of a larger strategy to address SAHS billing activity within Accountable Care Organizations’ (ACOs) reconciliation. The final rule outlines benchmarks for ACOs beginning new agreement periods in 2024, 2025, and 2026, and factors for ACOs applying for a new agreement period starting January 1, 2025. The rule also addresses billing activity concerns for intermittent urinary catheters on Medicare Durable Medical Equipment claims.

CMS Announces $1.4 Million Minority Research Grant Program Awards to Address Health Care Disparities. The Centers for Medicare & Medicaid Services (CMS) Office of Minority Health announced on September 24, 2024, that six recipients have received the 2024 Minority Research Grant Program (MRGP) awards, which supports researchers at minority-serving institutions to address health care disparities. Each recipient will receive awards of up to $237,500, totaling $1.4 million, to examine critical public health disparities and increase health equity research capacities at those institutions. Awardees include Palo Alto College; Research Foundation CUNY on behalf of Lehman College; San Diego State University Foundation; North Carolina Agricultural and Technical State University; Research Foundation of the State University of New York; and Fayetteville State University.

CMS Hospital Pricing Data Lacks Completeness, Accuracy, GAO Finds. Fierce Healthcare reported on October 3, 2024, that the Government Accountability Office (GAO) conducted a review of the Centers for Medicare & Medicaid Services (CMS) hospital pricing data requirements, following stakeholder complaints around difficulties making effective comparisons and compiling the data for large-scale use. The GAO found that CMS initiated 1,287 enforcement actions from 2021 to 2023, most often citing deficiencies related to missing data, inconsistent file formats, and noncompliance related to shoppable services or price estimator requirements. The GAO recommends that CMS assess whether hospital price transparency machine-readable files are sufficiently complete and accurate to be usable for supporting the program goal.

Industry News

MTM Completes Acquisition of Access2Care. Non-emergency medical transportation (NEMT) broker Medical Transportation Management (MTM) announced on October 8, 2024, that it has completed the acquisition of Access2Care, LLC from Global Medical Response. The transaction will expand MTMs operational footprint to all 50 states, the District of Columbia, and Puerto Rico, and increase annual revenue by approximately 25 percent.

Centene Completes Sale of Collaborative Health Systems to Astrana Health. Health Payer Specialist reported on October 9, 2024, that Centene completed the sale of its Florida-based subsidiary Collaborative Health Systems (CHS) to California-based Astrana Health. CHS builds comprehensive solutions for physicians as they move to value-based payment systems. Astrana also focuses on value-based care, offering technology solutions that enable providers to participate in value-based arrangements. The deal is still subject to regulatory approval. Financial terms were not disclosed.

Elevance Acquires Kroger’s Specialty Pharmacy Business. Health Payer Specialist reported on October 7, 2024, that Elevance Health has finalized its acquisition of Kroger’s specialty pharmacy business for an undisclosed amount. The specialty pharmacy, which serves patients with chronic illnesses requiring complex care, will merge into Elevance’s pharmacy benefits manager, CarelonRx.

HHAeXchange Acquires Sandata Technologies. HHAeXchange announced on October 3, 2024, that it has acquired Sandata Technologies, a homecare industry solutions provider. Financial terms of the transaction were not disclosed.

UnitedHealthcare Sues CMS Over Medicare Advantage Star Rating. Modern Healthcare reported on October 3, 2024, that UnitedHealthcare has filed a lawsuit against the Centers for Medicare & Medicaid Services (CMS) over a decline in its Medicare Advantage star rating. The lawsuit alleges that CMS lowered the payer’s star rating after conducting a secret shopper phone call, which United claims was done improperly and therefore not valid to be used in its rating calculation. United is seeking to have its rating recalculated and for CMS to remove the phone call from its calculation records.

Four Non-profit Health Systems Launch Longitude Health to Improve Health Care Delivery. Modern Healthcare reported on October 8, 2024, that Baylor Scott & White Health, Memorial Hermann Health System, Novant Health, and Providence have established a new for-profit company, Longitude Health, aimed at improving health care delivery. The for-profit entity will have three operating companies with each focusing on one of the following: improved access to drugs, care coordination for Medicare Advantage patients, and streamlined billing. Paul Mango, former chief of staff at the Centers for Medicare & Medicaid Services, will serve as Longitude’s chief executive and all four health systems’ chief executives will serve on the board.

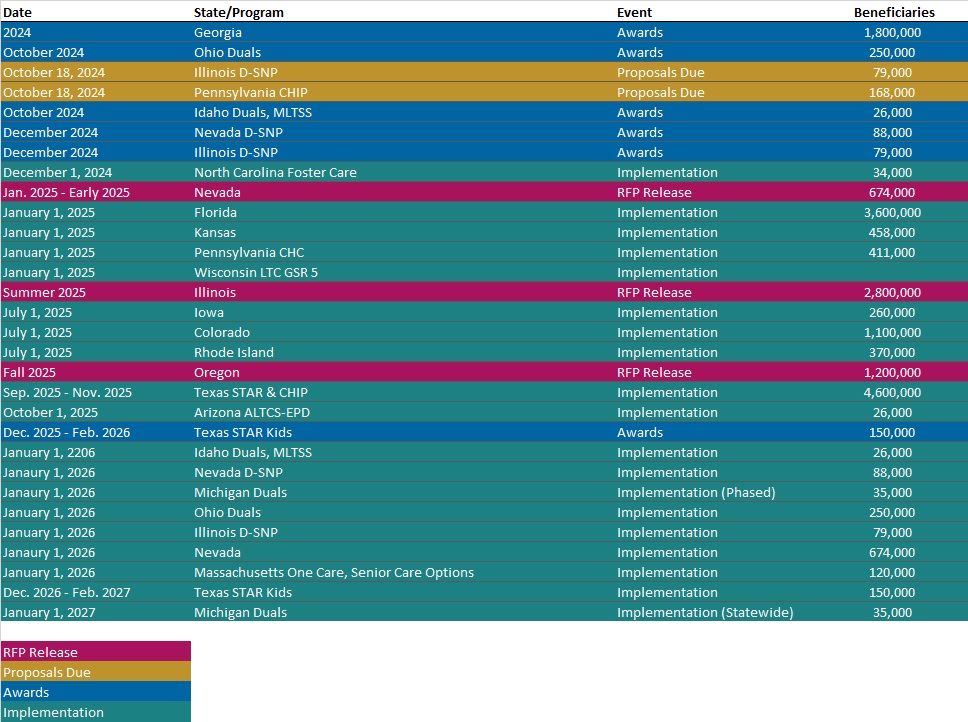

RFP Calendar

HMA News & Events

NEW THIS WEEK ON HMA INFORMATION SERVICES

(Exclusive Access for HMAIS Subscribers):

HMAIS Reports

- HMA Federal Health Policy Quick Takes

- Updated Section 1115 Medicaid Demonstration Inventory

Medicaid Data

Medicaid Enrollment:

- Florida Medicaid Managed Care Enrollment is Down 10.6%, Jul-24 Data

- Georgia Medicaid Managed Care Enrollment is Down 7.3%, Oct-24 Data

- Maryland Medicaid Managed Care Enrollment Is Down 5.2%, Aug-24 Data

- Michigan Medicaid Managed Care Enrollment is Down 13.6%, Jul-24 Data

- Missouri Medicaid Managed Care Enrollment is Down 9.3%, Aug-24 Data

- Ohio Medicaid Managed Care Enrollment is Down 4.2%, Apr-24 Data

Public Documents:

Medicaid RFPs, RFIs, and Contracts:

- Massachusetts One Care, Senior Care Options RFR, Awards, and Responses, 2023-24

Medicaid Program Reports, Data, and Updates:

- Kansas KanCare Program External Quality Review Reports, 2020-24

- Maine Prescription Drug Affordability Board Meeting Materials, 2022-24

- Michigan Update to Medicaid Coverage for Doula Services Proposed Policy, Sep-24

- Minnesota DHS Expenditure Forecast, 2023-24

- New York Section 1332 State Innovation Waiver Documents, 2023-24

- Pennsylvania MLTSS Subcommittee Meeting Materials, Sep-24

- West Virginia Medicaid Mountain Health Trust Annual Reports, SFY 2011-24

- West Virginia Medicaid Mountain Health Promise Annual Report, SFY 2024

- Wyoming Medicaid Annual Reports, SFY 2013-23

A subscription to HMA Information Services puts a world of Medicaid information at your fingertips, dramatically simplifying market research for strategic planning in healthcare services. An HMAIS subscription includes:

- State-by-state overviews and analysis of latest data for enrollment, market share, financial performance, utilization metrics and RFPs

- Downloadable ready-to-use charts and graphs

- Excel data packages

- RFP calendar

If you’re interested in becoming an HMAIS subscriber, contact Andrea Maresca at [email protected].