HMA Weekly Roundup

Trends in Health Policy

This week's roundup:

- In Focus: Congress Continues Negotiations on 2025 Spending and End-of-Year Package

- In Focus: CMS Announces Medicare Advantage Value-Based Insurance Design Model Will End After 2025

- In Focus: MyCare Ohio: The Next Generation’s Impact on the Ohio Medicare and Medicaid Landscape

- California Receives Federal Approval for Section 1115 CalAIM, BH CONNECT Demonstrations

- Florida to Submit New Health Care Workforce Sustainability Section 1115 Demonstration

- Centene Intends to Protest Georgia Medicaid Managed Care Contract Awards

- Idaho Provides NOIA to Molina Healthcare for Medicaid Dual, MLTSS Contract

- Ohio Releases Medicaid 1115 Demonstration Application with Work Requirements

- South Dakota Medicaid to Cover Doula Childbirth, Postpartum Support

- Wisconsin to Launch Housing Support Services Initiative for Medicaid Beneficiaries

- CMS Announces Five-year Strategy to Improve Health Care Delivery and Care Experience

- Senators Introduce Bill Forcing Insurers, PBMs to Sell Pharmacy Businesses

- Sanofi Files Lawsuit Over 340B Rebate Model

- More News Here

This week, we present an expanded version of the HMA Weekly Roundup with additional In Focus pieces. The HMA Weekly Roundup will resume on January 8, 2025. Happy Holidays!

In Focus

Congress Continues Negotiations on 2025 Spending and End-of-Year Package

This week, our In Focus section reviews the year-end legislative package congressional leaders announced as part of the stopgap funding to prevent a government shutdown. The package, which was unveiled December 18, 2024, would extend expiring Medicaid and Medicare policies, reauthorize health and human services programs, and extend federal funding for discretionary programs through March 14, 2025. The existing temporary funding measure expires December 20, 2024.

Following is a summary of several major healthcare policies that, if approved, will inform the shifting federal policy landscape and state and local programs in 2025.

Pharmacy Benefit Managers

The healthcare package includes policies that reflect several years of increased scrutiny on pharmacy benefit managers (PBMs), including:

- Prohibiting PBMs from charging a Medicaid managed care organization more for a drug than the amount that a PBM pays a pharmacy (i.e., spread pricing)

- Requiring consistency and additional transparency in contracts between Part D plans and PBMs

- Prohibiting Medicare Part D plans from linking payments to drug list prices

- Adding report requirements for PBMs

Medicaid Policies and Programs

The legislative text includes 13 separate sections that address Medicaid policies, including extensions on expiring policies, establishment of new programs, and plans to codify certain other policies related to Medicaid eligibility and renewals. These policy changes include:

- Medicaid Disproportionate Share Hospital (DSH) allotment: Eliminates reductions for fiscal year (FY) 2025; delays the effective date of the two remaining years of Medicaid DSH allotment reductions until January 1, 2027; and changes the definition of the Medicaid shortfall component of the Medicaid DSH cap to include costs and payments for patients who have Medicaid as their primary source of coverage and for patients who are dually eligible for Medicare and Medicaid.

- Home and community-based services (HCBS) waiver: Establishes a three-year, five-state Medicaid HCBS waiver program, which would allow states to cover these services for individuals who need them but do not meet the current statutory requirement of needing “institutional level of care.” States will have an opportunity to apply for planning grants.

- Services for juveniles leaving public institutions: Delays by 12 months the requirement that state Medicaid programs provide screenings, diagnostic services, and targeted case management services for eligible juveniles within 30 days of their scheduled date of release from a public institution following adjudication.

Medicare Payments

The compromise package also increases the Medicare Physician Fee Schedule conversion factor by 2.5 percent in 2025 to partially offset a 2.83 percent cut that the Centers for Medicare & Medicaid Services (CMS) finalized in November. Providers consider this a short-term fix, however, and Congress, provider advocates, and other interested parties are engaged in discussions about making broader changes to Medicare physician pay in 2025.

Notably, the agreement includes a payment policy consistent with a bill that the House of Representatives passed earlier this year—the Lower Cost More Transparency Act—to provide enhanced information about payment differentials between off‐campus outpatient departments and other outpatient facilities. The provision requires each off-campus outpatient department to obtain and bill for services under a unique national provider identifier.

Other notable Medicare policies include:

- Telehealth: Extends Medicare telehealth flexibilities through December 31, 2026; establishes special rules for telehealth services provided by Federally Qualified Health Centers and Rural Health Clinics for prospective payment and all-inclusive rates; adds modifiers for telehealth services provided incident-to other services and those offered via contracts with virtual platform vendors; expands services that can be provided via telehealth; and enhances tracking of telehealth use

- Payment extensions: Extends the Medicare low-volume hospital payment adjustment and Medicare-dependent hospital program through December 31, 2025; Medicare ground ambulance add-on payments through December 31, 2026; incentive payments for advanced alternative payment models through payment year 2027 at an adjusted amount of 3.53 percent; and Qualifying Participant eligibility thresholds in effect for performance year 2023 through payment year 2027

- Hospital at-home program: Extends the Acute Hospital Care at Home initiative through December 31, 2029

- Part D: Prohibits cost sharing for generic drugs for Part D beneficiaries who are eligible for the low-income subsidy

- Provider directories: Requires Medicare Advantage plans to maintain accurate provider directories on a public website beginning in plan year 2027

- Screening: Adds multi-cancer early detection screening tests as a covered benefit beginning in 2029

- Home infusion: Allows coverage of home infusion treatments by classifying certain approved infusion treatments as Durable Medical Equipment (DME)

Other Notable Provisions

- Reauthorizes and revises the Second Chance Reauthorization Act of 2024, including allowing substance use disorder (SUD) services to be provided through the State and Local Reentry Demonstration Projects program

- Reauthorizes and modernizes several aspects of child welfare programs

- Provides mandatory funding for community health centers and the National Health Service Corps through FY2026, the Teaching Health Center Graduate Medical Education Program through FY2029, and the Special Diabetes Programs (SDP) for Type I diabetes and the SDP for Indians through FY2026

- Reauthorizes through FY 2029 the SUPPORT for Patients and Communities Act, which includes a range of mental health and SUD prevention, treatment, and recovery programs

- Reauthorizes Older Americans Act programs

- Reauthorizes several programs and authorities related to preparedness and response through FY2026, including the Public Health Emergency Preparedness Program and the Hospital Preparedness Program

What’s Next

Funding for the federal government expires December 20, 2024. Congress will need to approve another temporary measure to avert a government shutdown. The length and scope of such an extension remains under discussion, though the current continuing resolution would push the funding deadline into the first few months of the incoming Trump Administration and new Congress. Healthcare stakeholders, including payers, state and local governments, providers, and community organizations, should continue to monitor the congressional negotiations and be prepared to analyze the impact of legislation that Congress ultimately approves.

Connect with Us

Health Management Associates, Inc. (HMA) experts will continue analyzing the implications of the funding and policy updates in the December 18 package and ongoing congressional discussions to reach an agreement. HMA’s experts have the depth of knowledge, experience, and subject matter expertise to assist organizations with navigating these changes and the impact for health and health adjacent sectors. Please contact Laura Pence and Andrea Maresca to connect with our experts.

CMS Announces Medicare Advantage Value-Based Insurance Design Model Will End After 2025

The Centers for Medicare & Medicaid Services (CMS) announced on December 16, 2024, that it will be terminating the Medicare Advantage Value-Based Insurance Design (VBID) model at the end of 2025 because of the model’s “substantial and unmitigable costs to the Medicare Trust Funds.” This In Focus article delves into the factors driving CMS’s decision and considerations for policymakers, Medicare Advantage Organizations and other interested stakeholders.

VBID Outcomes

VBID, run by the CMS Innovation Center, is not a permanent part of the Medicare Advantage (MA) program. Innovation Center models are required to be modified or terminated if they are a cost to the program.

CMS found that costs for the VBID model totaled $2.3 billion in calendar year (CY) 2021 and $2.2 billion in CY 2022, an unprecedent amount for an Innovation Center model. CMS concluded that these substantial expenses—driven by increased risk score growth and Part D expenditures—were unmitigable through policy modifications. Therefore, consistent with statutory requirements, CMS took action to terminate the model by the end of 2025. Earlier this year, CMS announced it would discontinue the part of VBID that allowed MA plans to offer hospice services.

Next year, the VBID model will have 62 participating MA plans and is projected to offer 7 million Medicare beneficiaries additional benefits and/or rewards, including those designed to address social determinants of health and reduce cost-sharing for prescription drugs used to treat and manage chronic conditions. As part of the announcement, CMS pledged to support a stable transition for all enrollees in MA plans participating in the MA-VBID model and emphasized that key benefits available under the model will continue to be widely available, including supplemental benefits that address the whole-person healthcare needs of beneficiaries. In addition, CMS noted beneficiary cost-sharing for prescription drugs will be reduced as the result of the expansion of the low-income subsidy program under the Inflation Reduction Act and the CMS Innovation Center’s Medicare $2 Drug List Model, which is slated to begin in 2027.

As part of the announcement, CMS released an executive summary of a forthcoming evaluation report, with the full report expected to be released in early 2025.

Key Considerations

Since the MA-VBID model’s launch in 2017, the program has experienced significant growth through a series of legislative and model changes, including requirements in the Bipartisan Budget Act of 2018 that expanded eligibility to MA plans in all 50 states and allowing all types of MA special needs plans to participate in MA-VBID. Previous CMS evaluations found that the MA-VBID model led to improvements in the quality of care for beneficiaries and promoted greater adherence to prescription drugs used to treat and manage chronic conditions. Though CMS has concluded that excess costs require the termination of MA-VBID by the end of 2025, the incoming Trump Administration can be expected to closely examine this decision and look at the entire Innovation Center portfolio.

Connect with Us

Health Management Associates, Inc. (HMA), Medicare experts will continue to assess and analyze the response to CMS’s announcement, including the incoming administration’s views on the decision and potential alternatives. HMA’s experts have the depth of knowledge, experience, and subject matter expertise to assist MA organizations and interested stakeholders in analyzing and adapting to the marketplace as the MA-VBID program ends.

For further analysis of the MA-VBID decision and its impact on the market, contact Greg Gierer, Amy Bassano, and Julie Faulhaber.

MyCare Ohio: The Next Generation’s Impact on the Ohio Medicare and Medicaid Landscape

This week, our In Focus section also reviews the significant efforts under way in Ohio to transform how the state provides healthcare services to its Medicare and Medicaid dual-eligible population. Effective January 1, 2026, MyCare Ohio will transition to the Next Generation of its program for people who are dually eligible for both programs.

Overview of Ohio’s Transition to Next Generation MyCare Ohio

This evolution moves Ohio to a fully integrated dual-eligible special needs plan (FIDE-SNP) model that seeks to achieve several key goals through a population-based health approach designed to address inequities and disparities in care for dual-eligible individuals. Examples include:

- Improved Care Coordination: Strengthening integration between Medicare and Medicaid services to provide seamless, holistic care for individuals, thereby reducing fragmentation and ensuring comprehensive management of medical, behavioral, and social needs

- Personalized Care: Applying data analytics and technology to create more tailored care plans, with a focus on proactive care to address the unique health needs of each individual, especially people with chronic conditions

- Expanded Access to Services: Increasing accessibility, particularly through telehealth and digital tools, to reach underserved populations and improve accessibility, particularly for people living in rural or remote regions

- Enhanced Quality of Care: Shifting focus from service volume to outcomes, encouraging providers to deliver high-quality care and improve patient satisfaction, while incentivizing preventive care to reduce hospital admissions and other high-cost interventions

- Technology Integration: Leveraging advanced technologies like mobile apps, predictive analytics, and telemedicine to monitor patient health, improve communication between patients and providers, and deliver care more efficiently

The MyCare program currently is offered in 29 counties across Ohio but will transition to a statewide program as a part of the Next Generation changes. In addition, coordination only dual-eligible special needs plans (CO-DSNP) will no longer be permitted.

After the Ohio Department of Medicaid (ODM) publicly released the request for applications and evaluated submitted proposals, the agency selected four managed care organizations (MCOs), which will become the Next Generation MyCare plans. The ODM awarded contracts to the following MCOs that will serve MyCare members beginning in January 2026: Anthem Blue Cross and Blue Shield, Buckeye Health Plan, CareSource, and Molina HealthCare of Ohio.

Considerations for the Market

The shift to the FIDE-SNP model and selection of four participating health plans will have a considerable impact on the competitive landscape for Medicare and Medicaid managed care in Ohio. The resulting changes may affect both selected and non-selected participants in different ways, including:

- Increased competition among MyCare MCOs: MCOs will need to focus on enhancing their care coordination systems, adopting new technologies, and developing personalized care plans to compete not just in terms of the volume of services provided, but also to the quality and effectiveness of healthcare delivery. Those plans that can best integrate services, offer proactive care management, and improve patient outcomes through value-based care and advanced technology initiatives will gain the competitive advantage, potentially attracting more beneficiaries.

- Strategic responses of nonparticipating MCOs to counter potential membership and financial losses: MCOs that lose members because they were not selected or are unable to offer CO-DSNPs moving forward, will likely strategize to gain membership through other product lines or benefit design to offset losses. Strategies may vary but might include tactics such as: enhancing benefits or decreasing member cost sharing to entice member movement across carriers for non-D-SNP plans; finding innovative ways to further reach different segments of the Medicare population, such as Special Supplemental Benefits for the Chronically Ill (SSBCI) packages or Chronic Condition SNP plans; or shifting their focus to product lines outside of Medicare Advantage and Medicaid.

Connect with Us

Ohio is one of many states transitioning to a FIDE model beginning January 2026. Health Management Associates, Inc. (HMA), has successfully supported participating and nonparticipating carriers throughout the transition process and continues to be a dedicated partner to organizations navigating Medicare and Medicaid changes across the country.

Contact Falon Owen, one of our featured experts, to learn more about the Ohio FIDE-SNP initiative and HMA’s capabilities and expertise to support states, carriers, and other key partners with these transitions.

HMA Roundup

Alabama

Alabama MCO Proposes Private Option Program Using Medicaid Expansion Funds to County Commissioners. The Alabama Reflector reported on December 12, 2024, that Blue Cross and Blue Shield of Alabama has proposed the ALLHealth plan, a private option using Medicaid expansion funding. Alabama, which has a Republican-controlled Legislature, is currently not a Medicaid expansion state. ALLHealth would provide insurance to about 113,000 individuals in the coverage gap and provide up to an additional 220,000 individuals with premium assistance on employer-provided insurance. The plan was proposed to the Association of County Commissions of Alabama, which is expected to vote on supporting the program in its 2025 platform.

Arkansas

Arkansas Legislative Council Subcommittee Advances PASSE Prior Authorization Exemption. The Northwest Arkansas Democrat Gazette reported on December 16, 2024, that the Legislative Council’s Hospital and Medicaid Study Subcommittee advanced plans from four Arkansas Provider-Led Shared Savings Entities (PASSEs) for an exemption or reduction on prior authorization restrictions, made available under provisions of the 2017 state law. The organizations include Summit Community Care, CareSource, Empower Healthcare Solutions, and Arkansas Total Care.

California

California Receives Federal Approval for Section 1115 CalAIM Demonstration Youth Reentry Services, HRSN Amendment. The Centers for Medicare & Medicaid Services (CMS) announced on December 16, 2024, that it has approved California’s amendment to the Section 1115 California Advancing and Innovating Medi-Cal (CalAIM) Demonstration, extending the state’s approved reentry demonstration amendment to cover individuals under 21 incarcerated in an adult facility or incarcerated former foster care youth without needing to meet certain health-related criteria. All other individuals receiving pre-release services must meet a health-related criteria outlined in CalAIM’s special terms and conditions. The amendment also authorizes the state to provide health-related social need (HRSN) services to Children’s Health Insurance Plan enrollees, increases CalAIM housing intervention services to address HRSNs, and makes other technical changes.

California Receives Federal Approval for Section 1115 BH-CONNECT Demonstration. The Centers for Medicare & Medicaid Services (CMS) released on December 16, 2024, that it has approved California’s new Section 1115 Behavioral Health Community-Based Organized Networks of Equitable Care and Treatment (BH-CONNECT) demonstration, effective through December 31, 2029. The demonstration includes initiatives related to strengthening the behavioral health workforce and delivery system; addressing health-related social needs; supporting youth in the child welfare system; providing transitional care management services for individuals with significant behavioral health needs who are returning to the community; and providing treatment for serious mental illness. This demonstration also authorizes expenditure authority for Designated State Health Programs (DSHP) to support workforce initiatives.

Connecticut

Connecticut Releases State Medicaid Landscape Analysis Results. Hartford Business/CT Mirror reported on December 12, 2024, that Connecticut Medicaid currently has a 14 percent lower per-enrollee spend than peer states in the Northeast, according to a Medicaid Landscape Analysis report commissioned by Governor Ned Lamont to consider a possible return to a Medicaid managed care model. Additionally, access to care for Connecticut Medicaid enrollees is in line with national benchmarks, and the state spends 3.8 percent of Medicaid expenditures on administrative costs versus 9.4 percent spent on average by states with managed care. The program did perform worse than the median state score for approximately 53 percent of quality measures focused on acute and chronic conditions.

Florida

Florida to Submit New Health Care Workforce Sustainability Section 1115 Demonstration. The Florida Agency for Health Care Administration (AHCA) announced on December 12, 2024, that it plans to submit a Section 1115 demonstration, titled “Florida Health Care Workforce and Sustainability,” to the Centers for Medicare & Medicaid Services. The five-year demonstration seeks to address healthcare workforce challenges by implementing workforce recruitment and retention programs. The agency is requesting federal matching funds to implement training, certification, and loan repayment programs for qualified practitioners who will operate in medically underserved Florida communities or professional shortage areas, as well as for healthcare facilities that provide training for students in specific disciplines. AHCA will hold public hearings on January 8, 2025, and January 10, 2025, to discuss the demonstration. Public comments will be accepted until January 24, 2025.

Florida Files Motion to Dismiss HCBS Oversight Lawsuit. Health News Florida reported on December 11, 2024 that the Florida Agency for Health Care Administration has filed a motion to dismiss a lawsuit regarding its oversight practices of Medicaid managed care organizations (MCOs) that provide home and community-based services (HCBS) to people who require long term care. The lawsuit, filed on behalf of five adults with disabilities, claims that MCOs do not provide enough information regarding their decisions to deny or reduce services, and that AHCA does not hold payers accountable in their hearing process for reviewing coverage decisions. AHCA’s motion argues that the plaintiffs do not claim to receive insufficient care today, that adverse benefit determinations or service interruptions have already been resolved, and that the plaintiffs have not alleged sufficient odds that similar experiences will occur again and cause harm.

Georgia

Centene Intends to Protest Georgia Medicaid Managed Care Contract Awards. Health Payer Specialist reported on December 13, 2024, that Centene/Peach State Health Plan intends to file a protest over the Georgia Families and Families 360° program contract awards, according to chief executive Sarah London on the company’s investor day. The incumbent plan did not receive a contract; Georgia awarded contracts to incumbent CareSource, and non-incumbents Humana, Molina, and UnitedHealthcare in December. Incumbent Elevance Health also did not receive an award. The deadline to file protests was extended to December 17 due to a delay in the release of some documents.

Idaho

Idaho Provides NOIA to Molina Healthcare for Medicaid Dual, MLTSS Contract. Molina Healthcare announced on December 16, 2024, that the Idaho Department of Health and Welfare (DHW) provided a notice of intent to award a contract to Molina Healthcare of Idaho for the state’s Medicare Medicaid Coordinated Plan (MMCP), a Fully Integrated Dual Eligible Special Needs Plan, and Idaho Medicaid Plus (IMPlus), a wraparound managed long term services and supports (MLTSS) program. Molina currently serves approximately 11,000 dual eligible members across Idaho. The program’s other incumbent is Blue Cross of Idaho. The contract is expected to begin January 1, 2026, and run for four years, with a potential one-year extension. As of the Daily Roundup’s publication deadline, DHW had not publicly posted information about the notice of intent to award.

Indiana

Indiana Medicaid Costs Projected to Increase by Up to Six Percent For Fiscals 2025 to 2027. The Indianapolis Star reported on December 17, 2024, that Indiana’s Medicaid costs are expected to grow around five to six percent for 2025, 2026, and 2027, according to new budget projections. The Indiana Family and Social Services Administration (FSSA) predicts total Medicaid expenditures will reach nearly $21 billion in fiscal 2025, up 6.4 percent from $19 billion in 2024, and will likely increase by at least another $1 billion in both 2026 and 2027. The increase in cost is partly attributed to higher than projected enrollment numbers. The projected increase comes a year after the state identified a $1 billion shortfall in the Medicaid budget for fiscal 2024, which resulted in FSSA implementing various cost containment measures.

Kentucky

KY Receives Federal Approval for All 1915(c) HCBS Waivers for New Rates. The Kentucky Department for Medicaid Services (DMS) announced on December 18, 2024, that it has received federal approval for rate-related amendments to all six of its 1915(c) Comprehensive Home and Community Based Services waivers, effective January 1, 2025. The increased rates are based on the 1915(c) HCBS waiver rate study and rate increases funded in the 2024-2026 state budget. Demonstrations being amended include Acquired Brain Injury; Acquired Brain Injury Long Term Care; Home and Community Based; Modell II Waiver; Michelle P. Waiver; and Supports for Community Living.

Kentucky Receives Federal Approval for Extension of TEAMKY Demonstration. The Centers for Medicare & Medicaid Services (CMS) announced on December 12, 2024, that it has approved Kentucky’s five-year extension for the Section 1115 TEAMKY demonstration, effective through December 31, 2029. This extension includes amendments that allow the state to provide short-term inpatient treatment services for individuals with serious mental illness residing in institutions for mental diseases; implement a health-related social needs initiative for episodic housing interventions with clinical services with room and board; and cover recovery residence support services.

North Carolina

North Carolina Medicaid Expansion Enrollment Surpasses 600,000. The Associated Press reported on December 16, 2024, that enrollment in the North Carolina Medicaid expansion program has surpassed 600,000 since launching in December 2023. The program has reached the state’s enrollment goal in about half the time that was originally projected, with more than a third of expansion enrollees coming from rural communities.

Ohio

Ohio Releases Medicaid 1115 Demonstration Application with Work Requirements. The Ohio Department of Medicaid announced on December 17, 2024, notice of its intent to submit a section 1115 Group VIII Demonstration application to the Centers for Medicare & Medicaid Services (CMS). The demonstration would require certain Medicaid expansion beneficiaries to meet at least one of the new criteria, which includes being at least fifty-five years of age; employed; enrolled in school or an occupational training program; participating in an alcohol and drug addiction treatment program; and have intensive physical health care needs or serious mental illness. The state will allow public comments through January 16, 2025.

Oklahoma

Oklahoma Announces SoonerSelect Oversight Vendor Contract Award, Presents 2025 Legislative Requests to Medicaid Agency Board. KGOU reported on December 13, 2024, that the Oklahoma Health Care Authority (OHCA) has awarded a contract to Accenture to serve as the monitoring and oversight vendor for the agency’s managed care program, SoonerSelect, which OHCA announced at its December board meeting. Accenture will help the agency develop technologies to process reports coming in from various SoonerSelect contractors. At the meeting, OHCA also outlined its legislative priorities for the 2025 session, including making changes to its reimbursement methodology for nursing homes, establishing a paid family caregiver program, and updating the Medical Advisory Committee to meet new federal requirements. OHCA’s main legislative request will include a larger budget to maintain its operations after an increase in the state’s Federal Medical Assistance Percentage.

South Dakota

South Dakota Medicaid to Cover Doula Childbirth, Postpartum Support. South Dakota Searchlight reported on December 11, 2024, that South Dakota Medicaid will begin covering doula services beginning January 1, 2025. Eligible beneficiaries will receive prenatal care and up to $1,800 of postpartum care within 18 months of delivery. Medicaid enrollees will need a referral from a licensed practitioner to qualify for services and doulas must be certified through programs approved by the South Dakota Department of Social Services.

Wisconsin

Wisconsin to Launch Housing Support Services Initiative for Medicaid Beneficiaries. The Wisconsin Department of Health Services reported on December 11, 2024, that it will launch a new initiative in February 2025 to provide housing support services to adult Medicaid members experiencing housing insecurity who are also affected by substance use or mental health conditions. Services will include assistance and resources to find housing, coverage of initial setup expenses such as security deposits, but not rent or ongoing expenses. The services under this benefit will be provided by organizations that are affiliated with a Tribal nation or are part of the Continuum of Care Program in Wisconsin.

Wyoming

Wyoming Medicaid Agency Requests $18.6 Million for Provider Rate Increases. Wyoming Public Media reported on December 13, 2024, that the Wyoming Department of Health (WDH) has requested $18.6 million in supplemental budget funds to increase reimbursement rates for certain Medicaid physicians and create more full-time positions in the department. WDH is seeking to increase Medicaid reimbursement rates for obstetricians and gynecologists in an effort to help retain clinicians amid the state’s increasing maternity care desert, for child and behavioral health providers in the home health sector, and for physicians providing applied behavioral analysis therapy. Additionally, WDH’s request would make multiple contractor and part-time positions in the agency full time, including having a full-time employee to determine long-term care eligibility in the Medicaid program. Wyoming lawmakers will consider the request when the legislature reconvenes in January.

National

CMS Announces Five-year Strategy to Improve Health Care Delivery and Care Experience. The Centers for Medicare & Medicaid Services (CMS) announced on December 9, 2024, the “Optimizing Care Delivery: A Framework for Improving the Health Care Experience,” which presents the agency’s five-year strategy to improve healthcare delivery and the consumer’s healthcare experience by reducing administrative burdens. The framework highlights multiple CMS priorities, including integrating patient and caregiver voices to increase equity and care access; addressing the well-being of healthcare workers; improving the care approval process; and reducing redundant data collection, documentation, and reporting requirements.

Senators Introduce Bill Forcing Insurers, PBMs to Sell Pharmacy Businesses. Modern Healthcare reported on December 11, 2024, that Senator Elizabeth Warren (D-MA) and Josh Hawley (R-MO) and House representatives Jake Auchincloss (D-MA) and Diana Harshbarger (R-TN) introduced the Patients Before Monopolies Act of 2024 which would prohibit corporations that own pharmacy benefit managers or health insurers from also owning pharmacies. Under the bill, insurers would need to sell their pharmacy businesses within three years, and if any company is in violation they must divest all subsequent revenue.

MACPAC Releases 2024 MACStats Medicaid, CHIP Data Book. The Medicaid and CHIP Payment and Access Commission (MACPAC) released on December 18, 2024, the 2024 MACStats: Medicaid and CHIP Data Book, which includes Medicaid and Children’s Health Insurance Program (CHIP) data on eligibility and enrollment, benefits, service use, access to care, and state and federal spending. Total Medicaid spending grew 8.4 percent in fiscal 2023 to $900.3 billion. Total CHIP spending was $23.4 billion.

U.S. Senators to Introduce Bill Strengthening No Surprises Act Penalties. Modern Healthcare reported on December 16, 2024, that U.S. Senators Roger Marshall (R-KS) and Michael Bennet (D-CO) are expected to introduce legislation to strengthen penalties against health insurers that violate the No Surprises Act, which protects patients against unexpected out-of-network medical bills. The No Surprises Act Enforcement Act of 2024 would increase fines to $10,000 on insurers that fail to comply with reimbursements decided under the law’s arbitration system and would triple late or unpaid payments. The legislation also would apply penalties to insurers that owe emergency services providers, ambulances, and air ambulances.

Hospitals with High Medicaid Shares Have Lower Operating Margins, KFF Analysis Finds. KFF reported on December 18, 2024, that hospital aggregate operating margins and total margins remained below 2019 pre-pandemic levels in 2023, despite operating margins increasing 2.5 percentage points compared to 2022, according to an analysis examining hospital margins for non-federal general short-term hospitals in the U.S from 2018 through 2023. Operating margins in both rural and urban areas were lower than average among hospitals with high Medicaid shares. The analysis also found operating margins were 2.3 percent lower for hospitals in rural than urban areas in 2023.

Industry News

Sanofi Files Lawsuit Over 340B Rebate Model. Modern Healthcare reported on December 17, 2024, that Sanofi has filed a lawsuit against the U.S. Department of Health and Human Services (HHS) and the Health Resources and Services Administration (HRSA) over their decision to reject the pharmaceutical company’s rebate model, slated to begin in January. HRSA has threatened to impose fines and remove Sanofi from the Medicare and Medicaid programs if the company does not remove its proposal by December 20, which the agency claims is inconsistent with 340B program statutes. Johnson & Johnson, Eli Lilly and Bristol Myers Squibb have also filed lawsuits regarding the program.

House Judiciary Committee Opens Investigation Over Potential CVS Caremark Antitrust Violations. The Hill reported on December 12, 2024, that the House Judiciary Committee has opened up an investigation into CVS Caremark to determine if the pharmacy benefit manager (PBM) has violated antitrust laws. Committee Chair Jim Jordan (R-OH) requested the company’s documents and communications about pharmaceutical hubs, expressing concern that CVS bars independent pharmacies from taking part in these hub arrangements to eliminate competition. Pharmaceutical hubs, often sponsored by pharmaceutical companies, are a digital pharmacy service that serve as a liaison for specialty pharmacies and drug manufacturers to help patients access complex and high-cost medications.

Community Health Systems to Sell North Carolina Hospital to Duke University Health System. Modern Healthcare reported on December 11, 2024, that Tennessee-based Community Health Systems has signed a definitive agreement to sell Lake Norman Regional Medical Center in North Carolina to Duke University Health System. North Carolina-based Duke plans to acquire the 123-bed hospital and its related assets for about $280 million. The deal is expected to close in the first quarter of 2025.

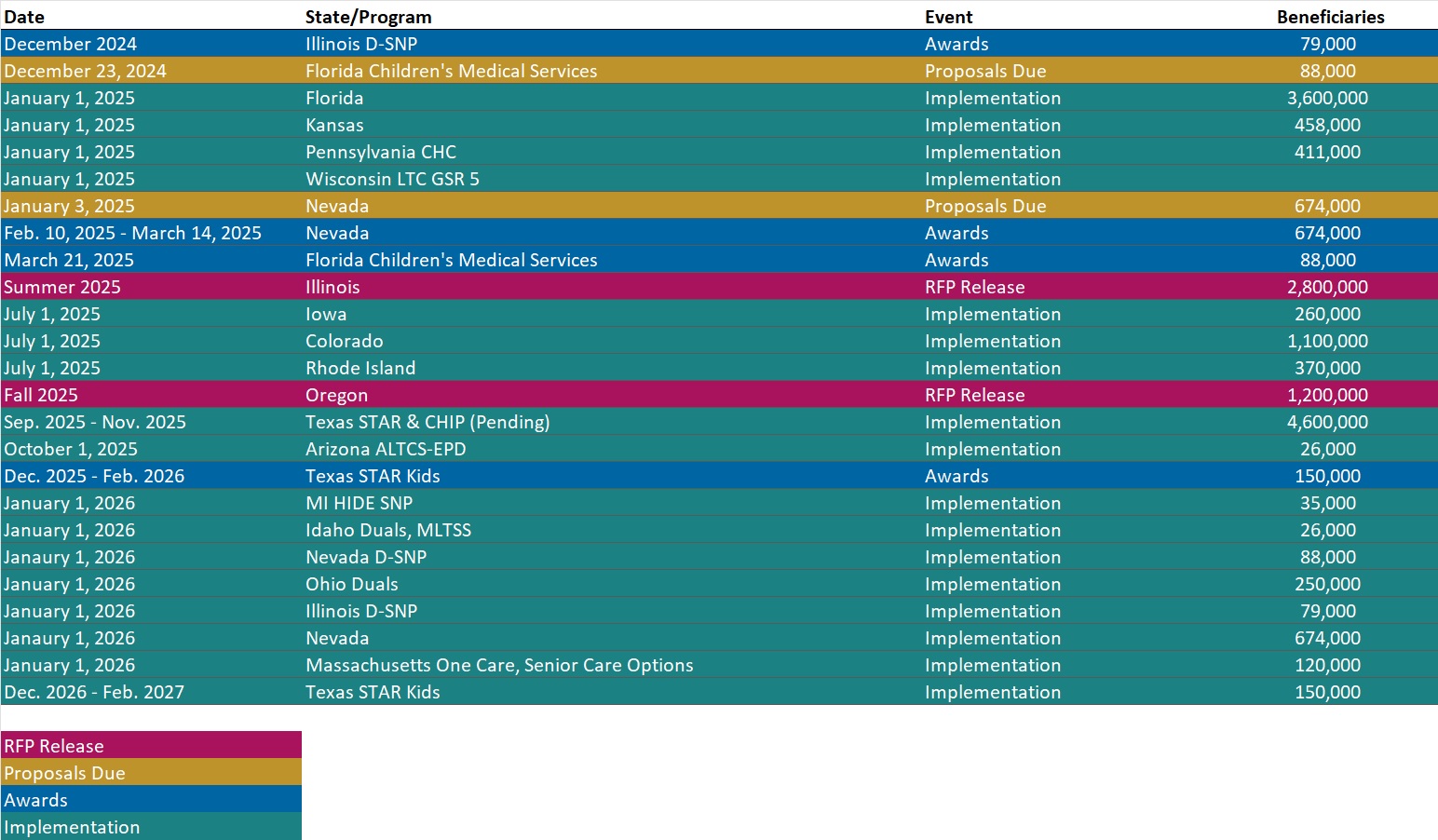

RFP Calendar

HMA News & Events

HMA Podcast

How Can Technology Empower Human Connection in Healthcare? Tom Cochran, partner at 720 Strategies, is a renowned expert in digital communication and healthcare public relations. Tom reflects on the broader impact of digital tools, acknowledging both their potential to connect us and their unintended consequences, such as cognitive overload and societal fragmentation. The conversation highlights practical strategies for navigating transitions in leadership—whether in politics or healthcare—and emphasizes the importance of understanding, listening, and adapting communication strategies to fit the moment. Tom leaves us with a reminder of the irreplaceable value of face-to-face interaction in an increasingly digital world. Listen Here

NEW THIS WEEK ON HMA INFORMATION SERVICES

(Exclusive Access for HMAIS Subscribers):

HMAIS Reports

- Special Needs Plans (SNP) Enrollment by State and Plan, Nov-24 Data

- Updated Non-Emergency Medical Transportation RFP Calendar

- Updated Medicaid Managed Care Rate Certifications Inventory

- Updated Florida State Overview

- HMA Federal Health Policy Quick Takes

Medicaid Data

Medicaid Enrollment and Financials:

- California Medicaid Managed Care Enrollment is Up 3.7%, Aug-24 Data

- Oregon Medicaid Managed Care Enrollment is Up 6.7%, Nov-24 Data

- South Dakota Medicaid Enrollment is Down 12.2%, FY 2024 Data

- South Dakota Medicaid Spending Over $1.5 Billion, FY 2024 Data

- West Virginia Medicaid Managed Care Enrollment is Down 7.5%, Sep-24 Data

Public Documents:

Medicaid RFPs, RFIs, and Contracts:

- Georgia Medicaid Care Management RFP, Proposals, Awards, Evaluations, Protests, HMA Analysis, and Related Documents, 2023-24

- Michigan Medicaid Cost Avoidance Third Party Liability Recovery Services RFP, Dec-24

Medicaid Program Reports, Data, and Updates:

- California CalAIM 1115 Waiver and Related Documents, 2021-24

- California BH-CONNECT Section 1115 Waiver Documents, 2023-24

- Connecticut DSS Medicaid Landscape Analysis Report, Dec-24

- District of Columbia Medicaid Managed Care Capitation Rate Report, FY 2025

- Florida Health Care Workforce Sustainability Section 1115 Demonstration Draft Application and Related Documents, Dec-24

- Indiana FSSA SFYs 2025-27 Medicaid Budget Forecast, Dec-24

- Kentucky 1915(c) HCBS Waiver Documents, 2017-24

- Kentucky TEAMKY (Formerly KY HEALTH) Section 1115 Demonstration Waiver Documents, 2020-24

- Louisiana Medicaid Managed Care Actuarial Rate Certifications and Data Books, 2018-25

- Minnesota Medicaid Managed Care Rate Certifications, CY 2025

- Ohio Group VIII Section 1115 Waiver Demonstration Application, Dec-24

- Oklahoma Health Care Authority Board Meeting Materials, 2024

- West Virginia Evolving West Virginia Medicaid’s Behavioral Health Continuum of Care Section 1115 Demonstration Documents, 2017-24

A subscription to HMA Information Services puts a world of Medicaid information at your fingertips, dramatically simplifying market research for strategic planning in healthcare services. An HMAIS subscription includes:

- State-by-state overviews and analysis of latest data for enrollment, market share, financial performance, utilization metrics and RFPs

- Downloadable ready-to-use charts and graphs

- Excel data packages

- RFP calendar

If you’re interested in becoming an HMAIS subscriber, contact Andrea Maresca at [email protected].