This week, our In Focus checks in on the Medicaid unwinding work and key issues HMA experts are watching as more states resume their normal policies and processes for determining eligibility. A total of 19 states started disenrollments effective for April or May coverage, and 22 additional states plan to start ending coverage this month. States are scheduled to submit the next monthly report by June 8, 2023.

Background

As explained in earlier In Focus articles, (January 12, 2023; November 12, 2022; and April 6, 2022) federal COVID-19 relief laws allowed states to receive higher federal funding for Medicaid as long as the state did not terminate Medicaid coverage for anyone enrolled in Medicaid during the public health emergency (PHE). One result of the continuous coverage policy was sustained growth in Medicaid enrollment; more than 21 million additional individuals were continuously enrolled in Medicaid for up to three years between February 2020 and March 2023. In December 2022, Congress ended the Medicaid continuous coverage policy after March 31, 2023. States were allowed to begin processing redeterminations as early as February 2023 and start disenrolling ineligible individuals as early as April 2023.

Preparations for the Medicaid unwinding have been under way for well over two years. The Centers for Medicare & Medicaid Services (CMS), states, Medicaid health plans, providers, beneficiary advocates, and other interested stakeholders have been working to ensure that the policies, outreach, and assistance are in place to support this massive eligibility renewal and redetermination initiative.

What Do We Know… Or Not Know?

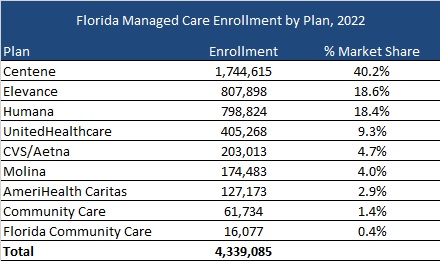

Most of the available forecasts project between 10-15 million enrollees will lose Medicaid coverage. The Health Management Associates (HMA) insurance mix model projects that more than 10 million of the approximately 90 million Medicaid enrollees are at risk for disenrollment. HMA’s model illustrates the variety in state approaches to managing the resumption of eligibility redeterminations as well as key insights related to the differential impact by Medicaid eligibility categories.

- Based on published information, the number of individuals who were disenrolled from Medicaid in April through May is likely to approach 500,000. In these early days of the unwinding period, HMA experts are closely reviewing the reports and engaging with key stakeholders in individual states. Several issues already are garnering more attention, such as the impact on child enrollment, churn and experiences in states using the extended reconsideration period flexibility, among others. Stakeholders will want to monitor how these and other program nuances evolve over the next year.

- We do not yet have robust or consistent data from the states that have resumed their normal processes for determining eligibility. States must submit disenrollment reports to CMS each month, and CMS must publish this information. The states are not, however, required to publish this information on their website. While some states have chosen to publish the data or plan to do so, there is no consistent approach to the specific data states post. For example, while most states publishing a state data dashboard are sharing the number of renewals they are processing each month, only slightly more than half also are sharing the number of renewals resulting in coverage terminations.

CMS is not expected to publish the state data before the end of June. Once this information is available, the state unwinding reports may provide a more comprehensive and consistent picture of enrollment over the next year.

In addition, the total number of “procedural terminations” currently is difficult to determine. Lack of consistent public reporting creates gaps in the data about the number of individuals disenrolled because they did not provide a timely response to the state’s request for more information (or for other procedural reasons). As Medicaid stakeholders know, the procedural disenrollment number is critical because these individuals could still be eligible for the program.

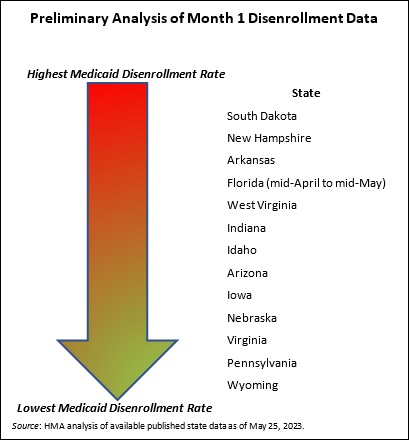

- Early disenrollment numbers should be analyzed carefully and in the context of the state. As noted earlier, the full eligibility renewal and disenrollment reports are unavailable at this time. We do know, however, that the available data is best analyzed in the context of the state’s unwinding plan (e.g., how the state is sequencing its eligibility reviews). The sequencing, pace, staffing, messaging consistency, partner outreach and assistance, and other factors will result in variation in state experiences. States are actively analyzing the data as the information is released and considering course corrections that may be needed, which could affect enrollment.

- Ongoing federal and state collaboration is improving preparations and allowing partners to address concerns as they arise. CMS and states have been transparent about the magnitude of the Medicaid unwinding and the fact that challenges will be inevitable throughout this process. The experiences reported by the first tranche of states to begin their unwinding period reinforce those points. They also provide important lessons for states that are or will shortly resume normal eligibility operations.

What to Watch

HMA’s experts are working with states, Medicaid health plans and their partners, providers, and advocacy organizations to identify and implement solutions to some of the known challenges. We also are looking ahead to forthcoming data, qualitative input, and other important developments that may inform federal and state policies and operations beyond the unwinding period.

- Unwinding trends. Though it is too early to definitively identify trends, HMA experts are monitoring the early state data, and we are prepared to analyze the CMS reports once they are published. We anticipate the CMS published data could be more instructive regarding the impact of the unwinding on enrollment, including states or regions that could benefit from additional outreach and assistance strategies, disproportionate impacts on certain demographic groups, new flexibilities that states may want to consider, and steps that health plans, hospitals and health systems, providers, and other partners could advance.

- State operational plans. As of late May, CMS officials reported they have not asked any state Medicaid agency to develop a corrective action plan related to the unwinding; however, this does not mean that federal officials do not have concerns about the experiences and data being reported out of certain states. States, their business partners, and advocates will all benefit from monitoring shifts in state plans, potential future CMS resources and direction to states such as additional reporting or modifying eligibility processes.

- Coverage Program Transitions. Significant attention has been appropriately placed on the Medicaid disenrollment numbers. HMA experts also are closely watching for new data on the number of individuals who successfully transition and enroll in qualified health plans offered in the Health Insurance Marketplaces. In the short term, the Medicaid unwinding could have a notable impact on total enrollment in Marketplace plans as well as provider payer mix. This could affect longer-term policy, strategy, and operational decisions for officials at the federal and state levels, managed care organizations, providers, and other stakeholders. For example:

- Health insurers should assess the opportunity to participate in the Marketplace program. Other insurers may need to develop new strategies to remain competitive in the Marketplace.

- Providers have similar assessments to conduct related to changes in the number of uninsured people to whom they deliver care, as well as their payer mix and the Marketplace plan networks in which they participate.

- Policymakers may revisit Marketplace regulations and standards in response to enrollment growth, enrollee demographics, and acuity of enrollees in Marketplace plans.

Medicaid agencies, health plans, all types of Medicaid providers, and advocacy organizations should continue to analyze their immediate needs during the Medicaid unwinding. They should also be planning to identify and incorporate lessons from this transition period, as well as preparing for policy and operations changes in the post-unwinding environment.

HMA: What We’re Watching

On June 8, 2023, the Health Care Payment Learning & Action Network (LAN) will hold a virtual meeting focused on accountable primary care. The LAN — an initiative supported by the Centers for Medicare & Medicaid Services (CMS) Innovation Center — is a group of public and private health care leaders that provide thought leadership, strategic direction, and ongoing support to accelerate our care system’s adoption of alternative payment models (APMs). During the session, CMS Administrator Chiquita Brooks-LaSure and the Innovation Center’s Deputy Administrator and Director Liz Fowler will share their vision for accountable primary care.

Over the past several months CMS leaders have discussed their intent to accelerate the transition to value-based care and more accountable primary care. They have identified key principals and hinted at certain components of a potential new primary care model. Additionally, the Innovation Centers’ earlier strategy documents have highlighted the imperative to include payers beyond Medicare, importantly Medicaid and commercial insurers, in models to achieve person-centered accountable and equitable care.

This meeting is notable because the Innovation Center’s models can drive transformational shifts in health care delivery and payment across public and private payers at the system and practice levels. Providers, health systems, insurers, and other interested stakeholders will want to closely monitor the LAN discussion for more information about CMS’ evolving thinking and future opportunities related to a potential model for accountable primary care. HMA experts are available to work with health care organizations and stakeholders to interpret and respond to developments flowing from the LAN session.

LAN meeting registration and information is available here.

If you have any questions, contact our experts below.