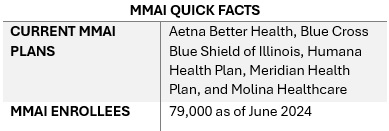

This week, our In Focus section from the HMA Weekly Roundup highlights the Illinois Department of Healthcare and Family Services request for proposals (RFP) for a dual-eligible special needs plan (D-SNP) to replace its current Medicare-Medicaid Alignment Initiative (MMAI) demonstration.

Overview

Illinois is one of the states affected by the Centers for Medicare & Medicaid Services (CMS) decision to end the capitated model in the federal Financial Alignment Initiative (FAI) demonstration. Illinois is among the last states to issue an RFP that will support the transition from the demonstration program. Two states, Texas and South Carolina, have yet to issue RFPs. On September 10, 2024, CMS issued a memo discussing end-of-demonstration enrollment and operational considerations and deadlines by which states should make operational decisions.

The Health Management Associates, Inc., (HMA) In Focus article June 26, 2024, discussed related changes that CMS finalized to the federal policy framework for D-SNPs to enhance care coordination, improve health outcomes, and ensure that dual-eligible beneficiaries receive accurate information about their healthcare while integrating successful features of the FAI demonstration and the Medicare-Medicaid Plan (MMP) program. These decisions are prompting more states to develop new models for integrating Medicare and Medicaid services.

Illinois D-SNP RFP Highlights

This Illinois procurement will transition the state to a fully integrated dual-eligible special needs plan (FIDE-SNP) model, which will include a requirement that plans provide managed long-term services and supports (MLTSS) for both people who are dually eligible and Medicaid-only beneficiaries beginning in 2027.

The RFP is largely focused on quality care provisions and improved care coordination across all services lines, including overall expectations to achieve the following:

- Improved access and quality of community-based behavioral health services

- Better quality of care in facilities

- Fewer program opt-outs

- A strategy for increasing the use of alternative payment models (APMs) in Medicaid managed care in Illinois, particularly for behavioral health providers

Emerging National Trends

Overall, the Illinois D-SNP procurement reflects broader national trends toward more coordinated, equitable, and outcome-focused healthcare.

Focus on Health Equity. The procurement emphasizes health equity and reducing disparities, including information on innovations that are responsive to health-related social needs (HRSNs) and social determinants of health (SDOH). The state is weighing payers’ experience partnering with non-traditional providers to meet Medicaid customers’ needs, their innovative programs to address customers who are difficult to locate, and their strategies for improving care for adults with complex needs in facility or community-based settings.

In addition, the state will require plans to report outcomes by race, ethnicity, and geography. Given the demographic and health equity reporting requirements, payers should be prepared to speak to their data collection, member engagement strategies, and relationships with community-based organizations. This capability will be an essential component of addressing both population health and health equity activities.

Alternative Payment Models. The RFP also requests detailed information on the payer’s strategy for increasing the use of APMs in Illinois Medicaid managed care, including the models the payer intends to implement. Experience supported by data-driven outcomes and explanations of work with providers or clinics to adopt, manage, and support reporting and analytics for APMs is a key area of interest for the state. Notably, the state seeks information on plans to include behavioral health providers in APMs.

Long-Term Services Related Transitions. The RFP questions also reflect the long-term services and supports that dually eligible beneficiaries need, as well as those of Medicaid-only beneficiaries who are eligible for these services. More specifically, the RFP raises questions to determine how payers will effectively implement nursing home diversion plans, incentivize hospitals to discharge patients to community settings, and approaches to transition members from institutional settings to the home and community, including by connecting members with supports for HRSNs. Payers will be expected to provide specific examples of their experience and outcomes in other states.

Emerging National Trends

The emphasis on health equity in the Illinois RFP reflects a broader national trend. States are increasingly interested in—and in some situations required—addressing SDOH and reduce disparities, especially for the Medicare and Medicaid dual-eligible population. As a result, payers and other healthcare organizations must develop capacity internally and through external collaborations to build their expertise and evidence base for advancing improvements.

The push for APMs in the Illinois procurement aligns with national efforts to move away from fee-for-service models. Illinois’s inclusion of behavioral health providers in APMs and requiring integrated care models highlights the growing recognition of the importance of mental health in overall health outcomes.

Illinois’s RFP also reflects heightened interest in improving care transitions and coordination. The potential for incentive programs related to community placement and increased focus on nursing home diversion will require innovative plans and a long-term commitment to working with all stakeholders to build on the federal FAI experiences.

What We’re Watching

Responses to the Illinois RFP are due October 18, 2024, and awards are expected to be announced in December. The state anticipates making awards to the top four bidders. Contract execution is estimated July 2025, with implementation January 1, 2026.

As the FAI demonstration ends and CMS’s integration requirements take effect over the next several years, there will be a steep learning curve for states, payers, and other key stakeholders adapting to this evolving environment. Compliance with new CMS rules will be crucial, and experiences in Illinois and other FAI demonstration states can provide valuable insights for other states and stakeholders.

Additional growth and program refinements in the federal Medicare Advantage (MA) landscape are expected in the coming years, especially among MA D-SNPs. Those MA D-SNPs that have yet to participate in Medicaid will need to continue make significant business decisions on participation and actively compete to secure state Medicaid contracts, which will have downstream implications for their state and local partners.

Connect with Us

Health Management Associates (HMA) experts continue to review the evolving landscape and federal changes that will affect D-SNPs in 2025 and beyond. Contact our featured experts below for details about the nationwide D-SNP rules and landscape.