HMA Weekly Roundup

Trends in Health Policy

This week's roundup:

- Shaping the Future: Join Us in Exploring Trends and Insights at the 2024 HMA Conference

- In Focus: A Cut Above the Rest: A Summary of 2025 Star Rating Cut Point Changes and Why They Matter

- Kentucky HCBS EVV System Go-live with Therap Pushed to January 2025

- Michigan Submits Application for New Section 1115 Reentry Services Demonstration

- Nevada Releases Medicaid Housing Supports, Services RFI

- Oklahoma Works on SPA to Expand School-based Medicaid Services

- South Carolina Coalition Pushes for Medicaid Expansion

- Washington Apple Health Pregnancy Programs Increase Income Limit Beginning in November

- CMS Releases Medicaid Managed Care MLR Monitoring, Reporting, Oversight Toolkit

- CMS Releases NOFO for Planning Grants to Address Care Continuity for Justice-involved Individuals

- States Could Improve Maternal Healthcare Access by Leveraging Medicaid Managed Care Requirements, HHS OIG Finds

- Tenet Healthcare Finalizes Sale of Majority Stake in Brookwood Baptist Health to Orlando Health

- More News Here

In Focus

Shaping the Future: Join Us in Exploring Trends and Insights at the 2024 HMA Conference

Health Management Associates, Inc. (HMA), 2024 Fall Conference, Unlocking Solutions in Medicaid, Medicare, and Marketplace Programs, is less than a week away—October 7−9 in Chicago, IL. Though online registration is now closed, you can still attend; onsite registration will be available.

HMA events are designed to equip participants with the knowledge and tools necessary to navigate complex healthcare challenges and drive organizational success. The conference features more than 50 industry speakers, including health plan executives, state Medicaid directors, policy experts, and providers.

The preconference workshop on October 7 will provide a unique opportunity to engage in hands-on exercises and interactive sessions led by HMA staff who are former leaders from the Centers for Medicare & Medicaid Services (CMS), former Medicaid and insurance directors from Rhode Island, Indiana, and Illinois, as well as C-level executives from managed care and industry. Notable preconference include:

- The transition to value-based care and initiatives centered on payment reform and health equity

- Community reentry initiatives for justice-involved populations

- Insights into Affordable Care Act marketplace innovations and transitions

- Practical guidance on navigating Medicaid’s 1115 demonstration processes

- The effective use of artificial intelligence in healthcare

The HMA conference plenary and breakout sessions on October 8−9 will focus on the landscape for innovation in healthcare, emerging service delivery models, and growth strategies in pursuit of improved value, quality, and better outcomes. As the November elections approach, our panelists also will provide informed perspectives on key policy issues and litigation that will be at play in 2025 and beyond. Panelists included in those discussions are former officials who have served in critical positions across all three branches of government under different leaders.

Here’s what else you can look forward to:

- Health plan executives discussing the future of integrated care for dually eligible individuals

- How efforts to address social determinants of health are leaning on the intersection of housing and health

- How sickle cell treatment innovation emphasizes the need for improved access to care for people enrolled in Medicaid

- Exploring strategies for Medicare to adequately compensate providers while ensuring value for beneficiaries and taxpayers

The HMA Fall Conference will bring together more than 300 industry leaders and experts from across the healthcare spectrum to foster conversations about ways to improve access, equity, and innovation in healthcare. The agenda and event details, including all confirmed speakers, can be found here.

A Cut Above the Rest: A Summary of 2025 Star Rating Cut Point Changes and Why They Matter

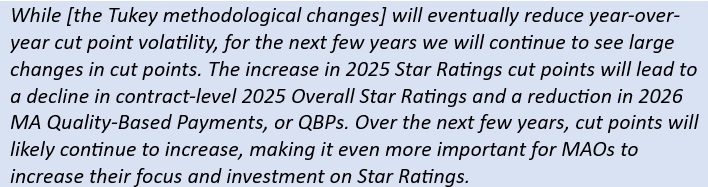

This week, our In Focus section highlights a white paper that Wakely, a Health Management Associates, Inc. (HMA), company published in September 2024, titled “A Cut Above the Rest: Summary of 2025 Star Rating Cut Point Changes.” The paper provides an in-depth analysis of the latest cut point changes from the Centers for Medicare & Medicaid Services (CMS) to demonstrate how policies like the Tukey Outer Fence Outlier removal logic (Tukey), guardrails, and changes in overall quality performance have led to the highest Medicare Advantage (MA) Star Rating cut points in the program’s history.

Why Cut Points Matter

MA Star Ratings are a critical measure of the quality and performance of MA plans. The MA Star Ratings cut points are the thresholds CMS has set to evaluate the performance of MA plans. These ratings, ranging from 1 to 5 stars, are based on various quality measures, including clinical outcomes, patient experience, and plan administration. CMS applies methodologies such as Tukey to set the cut points and guardrails to stabilize them over time. MA plans are evaluated and earn a rating that is based on their performance against the cut points. Higher Star Ratings can lead to increased enrollment and higher payments from CMS, making them a key focus for MA organizations.

Key Findings

Wakely used the 2025 Star Rating Technical Notes to analyze measure-level cut point changes. The data summarize how Medicare Advantage organizations (MAOs) performed on various quality measures during the 2023 measurement year. Notably, the Tukey methodology was applied for the first time within the 2024 Star Ratings cut points. Initially, the full impact of this methodology was evident in the initial 2024 Star Ratings, but the updated 2024 Star Ratings restricted use of guardrails and spread the impact of Tukey over a few years.

The analysis reinforces expectations for changes in MA spending in 2026, in part because of changes in Medicare Advantage Prescription Drug Overall Star Ratings.

Key Considerations

The Star Ratings have been on a steady decline over the last two years while CMS continues to refine and evolve its Star Ratings methodology and areas of focus. Key issues to consider in this climate include:

- MAOs are experiencing significant reductions in quality bonus and rebate payments, which potentially affects opportunities to improve member health outcomes.

- Strategies to enhance Star Ratings and elevate program quality are crucial for performance and meeting the unique needs of MA enrollees.

- MA plans and other stakeholders also should consider that as plans optimize performance on certain traditional quality measures, CMS is placing increased emphasis on member experience with their health plan and providers during care.

- The Star Ratings is an important tool CMS uses to redirect plan focus and resources.

CMS is scheduled to release the final scores and Star Ratings for Star Year 2025 in early October 2024. These ratings will be based on the performance data from the 2023 dates of service. This release will provide MAOs with updated quality and performance metrics, which are used to determine CMS Star Ratings and subsequent quality-based payments.

Connect with Us

For further insights into the Star Ratings and more information on the report, contact report authors Suzanna-Grace Tritt, ([email protected]), or Lisa Winters, ([email protected]).

Strategies and actions MAOs implement in 2024 and 2025 will affect their 2026 Star Ratings. For further insights into programmatic strategies, best practices for design of meaningful solutions to implement, and approaches to measure the effectiveness of these solutions, explore The HMA Stars Accelerator Solution.

HMA Roundup

California

Blue Shield of California Bypasses PBMs to Reduce Cost for Humira Biosimilar. Modern Healthcare reported on October 1, 2024, that Blue Shield of California reached an agreement to buy a lower-cost version of AbbVie Inc.’s Humira directly from the manufacturer, bypassing pharmacy benefit managers (PBMs). The insurer will pay for $525 a month for the Humira biosimilar beginning next year, which is about a quarter of what the company currently pays after rebates. The largest U.S. PBMs currently charge health plans notably more than $525 a month, with UnitedHealth’s Optum Rx’s lowest price for its Humira biosimilar at about $1,177 a month.

Illinois

Illinois Awards $6.5 Million to Insurance Navigators Ahead of State-based Marketplace Launch. Health News Illinois reported on October 1, 2024, that Illinois has awarded a total of $6.5 million to five different organizations that will act as navigators for people signing up for the upcoming state-based Marketplace launching in 2025. The Illinois Primary Health Care Association will receive $3.5 million, Rincon Family Services will receive $1.1 million, and the Federación de Clubes Michoacanos en Illinois, Sinai Community Institute, and the Springfield Urban League will receive a share of the rest. The Department of Insurance will oversee navigator training.

Kentucky

Kentucky HCBS EVV System Go-live with Therap Pushed to January 2025. The Kentucky Cabinet for Health and Family Services announced on September 30, 2024, an updated timeline for transitioning its state-sponsored electronic visit verification (EVV) system from Netsmart to Therap for the 1915(c) Home and Community Based Services waiver programs. The go-live for Therap has changed from October 24, 2024, to January 1, 2025.

Louisiana

Louisiana Increases Medicaid Rates at Seven Rural Hospitals. The Louisiana Illuminator reported on September 30, 2024, that Louisiana increased Medicaid rates for seven different rural hospitals, totaling an additional $22 million. While most of the rate increase will be funded with federal dollars, $5.2 million will come from the state general fund. The rate increase is contingent on federal approval.

Maryland

Maryland Renews Medicaid Contract with Kaiser Permanente for 2025. Maryland Matters reported on September 25, 2024, that the Maryland Department of Health has renewed Kaiser Permanente’s Medicaid managed care contract for 2025 after initially choosing to end the contract. New contracts include increased accountability and health equity, including screening patients for social needs such as food access, transportation, housing, and employment. Other plans include CVS/Aetna, Elevance/Wellpoint, UnitedHealthcare, Priority Partners/Johns Hopkins, Maryland Physicians Care, MedStar Family Choice, CareFirst Blue Cross Blue Shield/University of Maryland Health Partners, and JAI Medical Systems.

Michigan

Michigan Submits Application for New Section 1115 Reentry Services Demonstration. The Centers for Medicare & Medicaid Services announced on October 1, 2024, that Michigan submitted an application for a new section 1115 Reentry Services demonstration, which would include certain pre-release services up to 90-days immediately prior to release for eligible incarcerated individuals. Support services include case management, medication-assisted treatment for substance and alcohol use disorder, and up to a 30-day supply of medications upon release. The federal comment period will be open through October 31.

Missouri

Missouri Issues Emergency Rule Allowing Medicaid Reimbursement for Doula Services. The Missouri Independent reported on September 30, 2024, that Missouri issued an emergency rule allowing doulas to receive Medicaid reimbursement for the next six months, which aims to improve maternal health outcomes. Eligible doulas must have a current certificate from a national or Missouri-based doula training organization. Reimbursements will cover six total prenatal and postpartum doula visits, attendance at a birth, lactation education services and help navigating community services.

Nevada

Nevada Releases Medicaid Housing Supports, Services RFI. The Nevada Department of Health and Human Services Division of Health Care Financing and Policy (DHCFP) released on September 27, 2024, a request for information (RFI) from health care providers, recipients, and contracted Medicaid managed care organizations on developing housing supports and services—also known as in lieu of services (ILOS)—to qualified Medicaid managed care members in urban Clark and Washoe counties. DHCFP is looking for feedback on implementing supports such as specialized case management, housing transition support, housing-related deposits, and housing sustainment services. Responses are due October 27.

New York

New York Awards Single Statewide Fiscal Intermediary Contract for CDPAP to Public Partnerships. Crain’s New York Business reported on September 30, 2024, that New York has awarded Georgia-based Public Partnerships LLC (PPL) the single statewide fiscal intermediary for the state’s $9 billion consumer-directed personal assistance program (CDPAP), which operates the Medicaid home care system for 250,000 New Yorkers. The contract requires PPL to work with four organizations to handle administrative functions for the program, as well as a network of 30 home care agencies to provide care. PPL will also move its headquarters to New York as part of the agreement. The state did not disclose how much money it will award to PPL and the subcontractors.

Oklahoma

Oklahoma Works on SPA to Expand School-based Medicaid Services. KGOU reported on October 1, 2024, that the Oklahoma Health Care Authority (OHCA) and Oklahoma State Department of Education (OSDE) are working towards expanding Medicaid-covered services in the state’s schools. The agencies are working together to develop a state plan amendment to expand these services to cover all Medicaid-eligible children and to add additional services, such as dietician, nutrition, and substance abuse services by 2025. OSDE is also working on developing resources such as Medicaid manuals and billing guides to help support schools as they start or increase Medicaid billing. The work is supported by a $2.5 million Centers for Medicare & Medicaid Services grant that OHCA and OSDE received in July, which will run through June 30, 2027.

Oregon

Oregon Insured Rate Reaches 97 Percent in 2023. The Oregon Health Authority (OHA) announced on September 26, 2024, that an estimated 97 percent of Oregonians had health coverage in 2023, marking a record high, according to data from the Oregon Health Insurance Survey. Approximately one third of the remaining uninsured individuals are likely eligible for Medicaid. The survey also found that 7.7 percent of Hispanic or Latine individuals reported being uninsured in 2023, down from 27 percent in 2011.

Pennsylvania

Pennsylvania Increases Medicaid Behavioral Health Reimbursement Rates. The Pennsylvania Department of Human Services announced on September 30, 2024, that the state will increase reimbursement rates for its Behavioral HealthChoices Medicaid program, retroactive to July 1, 2024. The rate increase is contingent on federal approval. The state has increased its overall funding for behavioral health in other areas as well, including a $20 million investment in county mental health programs outlined in the 2024-25 budget, and a $5 million investment in crisis stabilization walk-in centers.

South Carolina

South Carolina Coalition Pushes for Medicaid Expansion. The Index-Journal reported on September 30, 2024, that a coalition of nearly 100 South Carolina non-profit organizations is urging legislators to implement Medicaid expansion. The group, consisting of health care providers and associations, civil rights groups, advocates, the Catholic Diocese for the state, and the Catawba Indian Nation, is using North Carolina’s expansion program as a model for how a Republican-controlled legislature could approve expansion.

Texas

Texas Expedited Medicaid Unwinding Could Have Led to Wrongful Disenrollments. The Texas Tribune reported on September 26, 2024, that Texas’ expedited approach to Medicaid redeterminations resulted in more than 2 million individuals losing coverage, of which 1.4 million beneficiaries were disenrolled due to procedural reasons. According to a ProPublica and Texas Tribune review of public and private records, Texas received persistent warnings from the federal government and could have avoided certain mistakes. The state launched reviews of about 17 percent of its caseload in the first month despite federal officials advising not to review more than 11 percent of caseloads each month, due to the risk of overwhelming their systems and wrongfully disenrolling individuals. Texas also opted against more widely adopting automatic renewals which was urged by the federal government, and instead required nearly everyone to resubmit documents proving they qualified. There is currently a backlog of more than 200,000 Medicaid applicants.

Virginia

Virginia Plan to Cut 200 Positions Due to Medicaid Disenrollments. WTKR reported on September 27, 2024, that Sentara Health is cutting nearly 200 positions across 10 states, with the majority in Virginia, due to the Medicaid redetermination process which caused a significant decline in Medicaid membership. Most of the impacted positions are in the company’s health plans division, with the rest being positions that function in support of health plan operations.

Washington

Washington Apple Health Pregnancy Programs Increase Income Limit Beginning in November. Washington Health Care Authority announced on September 27, 2024, that the Apple Health for Pregnant Individuals and After-Pregnancy Coverage (APC) income limit will increase from 193 percent to 210 percent of the federal poverty level, effective November 1, 2024.

Wisconsin

Wisconsin Medicaid Expansion Could Save the State $1.7 Billion Over Two Years. Wisconsin Public Radio reported on September 26, 2024, that Medicaid expansion in Wisconsin could save the state around $1.7 billion over the next two years by decreasing the number of individuals receiving state-funded health insurance, according to a study from the Wisconsin Policy Forum. Medicaid expansion would extend coverage to up to about 90,000 additional individuals, mostly for rural Wisconsinites, with about 23,000 going from being uninsured to having coverage.

National

CMS Releases Medicaid Managed Care MLR Monitoring, Reporting, Oversight Toolkit. The Centers for Medicare & Medicaid Services (CMS) released on September 30, 2024, a toolkit for states to ensure accurate monitoring, reporting, and oversight of Medicaid managed care and Children’s Health Insurance Program plan medical loss ratio (MLR) data. The toolkit also contains recommendations on improving MLR data collection and validation, using validated MLR information for financial monitoring and oversight, creating reporting guidance, and creating an effective oversight system within state Medicaid agencies. The guidance is a part of a series of toolkits to help states meet federal requirements for monitoring managed care.

CMS Releases NOFO for Planning Grants to Address Care Continuity for Justice-involved Individuals. The Centers for Medicare & Medicaid Services (CMS) released on September 27, 2024, a notice of funding opportunity (NOFO) for planning grants that will allow state Medicaid and Children’s Health Insurance Program (CHIP) agencies to address operational barriers and care continuity for Medicaid and CHIP-eligible people who are inmates at a public institution, including jails, prisons, and youth detention facilities. CMS will award up to 56 states and territories with up to $5 million over a four year period. In total, the program has $106,500,000 available. The first round of applications closes on November 26, 2024, and the second round closes on March 17, 2025.

States Could Improve Maternal Healthcare Access by Leveraging Medicaid Managed Care Requirements, HHS OIG Finds. Fierce Healthcare reported on October 2, 2024, that states could better leverage Medicaid managed care provider coverage requirements to help improve maternal healthcare access, according to a report by the U.S. Department of Health and Human Services Office of the Inspector General (HHS OIG). The report found that many states do not require their Medicaid managed care organizations to cover provider types beyond obstetrician/gynecologist (OB/GYN) physicians and hospitals. Furthermore, some states do not use network adequacy standards to address access and may lack data on the standards’ impact on access. HHS OIG recommends that the Centers for Medicare & Medicaid Services ensure states cover all required maternal healthcare services, clarify that all states must have a provider-specific OB/GYN network adequacy standard, and work with states to tailor network adequacy standards to better address needs.

CMS Implements Reduced Copays for 54 Medicare Part B Drugs. The Centers for Medicare & Medicaid Services (CMS) announced on September 30, 2024, that certain Medicare members will have reduced copays for 54 prescription drugs from October 1, 2024, through December 31, 2024, as part of the Inflation Reduction Act’s Medicare Prescription Drug Inflation Rebate Program. The cost of the 54 drugs, which treat conditions such as osteoporosis, pneumonia, and cancer, increased faster than the rate of inflation. Affected enrollees may save between $1 and $3,854 per day.

CMS Releases Report on Acute Hospital Care At Home Initiative. Fierce Healthcare reported on October 1, 2024, that the Centers for Medicare & Medicaid Services (CMS) released a study on the acute hospital care at home (AHCAH) initiative, which CMS approved during the pandemic. The report examines health outcomes and cost differences of hospital-at-home care versus inpatient brick-and-mortar hospital care. The findings show that the outcomes of the AHCAH initiative are consistent with its intentions to provide safe, quality care in home. However, the report recognizes that the study’s data, analytic, and measurement limitations restrict its ability to draw definitive conclusions on the initiative’s impact. The initiative is set to expire December 31.

Medicare Advantage, Part D Premiums to Remain Stable in 2025. The Centers for Medicare & Medicaid Services (CMS) announced on September 27, 2024, that Medicare Advantage (MA) and Medicare Part D premiums will remain stable, slightly lowering, in 2025. Average monthly premiums for all MA plans, including plans that provide prescription drug coverage and special needs plans, will fall from $18.23 in 2024 to $17.00 in 2025, and benefit options will remain stable. Part D premiums are set to decrease from $53.95 in 2024 to $46.50 in 2025 on average, though Part D premiums may be even lower for members who also get prescription drug coverage through an MA plan due to rebate dollars.

Medicaid Enrollment Drops by More Than 851,000 Million in June 2024, CMS Reports. The Centers for Medicare & Medicaid Services (CMS) reported on September 30, 2024, that enrollment in Medicaid and the Children’s Health Insurance Program (CHIP) was nearly 80 million in June 2024, reflecting a decrease in Medicaid enrollment of more than 851,000 from May 2024. Medicare enrollment was 67.5 million, up 95,742 from May 2024, including nearly 34.1 million in Medicare Advantage plans. More than 8 million Medicare-Medicaid dual eligible individuals are counted in both programs.

Medicaid Spending on HCBS LTSS Exceeds Institutional LTSS. McKnights Senior Living reported on September 30, 2024, that Medicaid home and community-based services (HCBS) spending accounted for 63.2 percent of long term services & supports (LTSS), and institutional services accounted for 36.8 percent in 2021, according to recently published data from the Centers for Medicare & Medicaid Services. HCBS spending increased each year from 2019 to 2020, despite enrollment decreasing. The largest share of HCBS users received state plan home health services; state plan rehabilitative services; state plan case management services; and Section 1915(c) waiver program services such as those used for assisted living.

Medicaid Coverage Associated with Positive Multigenerational Impacts. The Center for Medicaid and CHIP Services (CMCS) released on September 27, 2024, an issue brief which examines the impact of Medicaid coverage and eligibility over the last six decades, and reviews studies that show Medicaid is associated with improved health, mortality, and educational and economic outcomes. One of the studies examined found that access to Medicaid as a young child decreases the likelihood of being incarcerated by age 28. Additionally, mothers who gained Medicaid during early childhood themselves were found to give birth to healthier children when they started their own families.

CMS Omits Medicaid Drug Price Verification Survey Proposal from MDRP Final Rule. Stat News reported on September 26, 2024, that the Centers for Medicare & Medicaid Services (CMS) chose not to include a 2023 Medicaid drug price verification survey proposal in its Medicaid Drug Rebate Program (MDRP) final rule issued in September. The proposal would have required pharmaceutical companies to complete a survey disclosing the prices and research costs of certain Medicaid-covered prescription drugs that increased states’ overall Medicaid spending.

Medicare, Medicaid Enrollees Face OUD Medication Access Barriers, HHS OIG Finds. Behavioral Health Business reported on September 26, 2024, that some Medicaid and Medicare beneficiaries may not have access to medications for opioid use disorder (MOUD), according to a report by the U.S. Department of Health and Human Services Office of the Inspector General (HHS OIG). The report found that although the Centers for Medicare & Medicaid Services (CMS) has made targeted efforts to expand MOUD access, many MOUD providers did not treat any Medicare or Medicaid enrollees due to various factors such as low Medicaid reimbursement rates, Medicare Advantage prior authorization requirements, and inadequate information about MOUD provider locations. HHS OIG recommended that CMS geographically target its efforts to increase MOUD providers in high-need areas, work with states to assess reimbursement rates for MOUD providers, and work with the Substance Abuse and Mental Health Services Administration to develop a list of active buprenorphine providers.

CMS Releases EPSDT Guidance for Children Enrolled in CHIP, Medicaid. The Centers for Medicare & Medicaid Services (CMS) released on September 26, 2024, guidance for meeting Early and Periodic Screening, Diagnostic and Treatment (EPSDT) requirements for children covered by Medicaid and the Children’s Health Insurance Program (CHIP). The guidance explains statutory and regulatory EPSDT requirements and suggests best practices for increasing care access through transportation and care coordination, expanding the workforce, improving care for children with specialized needs, and increasing awareness of children’s rights under EPSDT. The guidance also includes information on addressing children’s behavioral health needs through strategies and best practices, such as creating a children’s behavioral health benefit package, supporting behavioral health management in a primary care setting, and providing mental health and substance use disorder services along the continuum of care.

Industry News

Tenet Healthcare Finalizes Sale of Majority Stake in Brookwood Baptist Health to Orlando Health. Modern Healthcare reported on October 1, 2024, that Tenet Healthcare completed the sale of its majority stake in Alabama-based Brookwood Baptist Health to Orlando Health in a $910 million cash deal. The deal includes five hospitals and related operations in Alabama, including Brookwood Baptist Medical Center, Citizens Baptist Medical Center, Princeton Baptist Medical Center, Shelby Baptist Medical Center, and Walker Baptist Medical Center.

Medicare Advantage Insurers Announce Plan Details for 2025. Reuters reported on October 1, 2024, that health insurers Cigna, CVS Health, Humana, Centene, and UnitedHealth released details on their Medicare Advantage plans for 2025, ahead of open enrollment beginning October 15. Aetna estimates 83 percent of Medicare-eligible beneficiaries will have access to a $0 monthly premium plan, and Humana will provide prescription drug benefit enhancements under the Inflation Reduction Act. UnitedHealth will be introducing 140 new plans for 2025, and Centene will offer a $0 copay for primary care physician visits on all plans. Medicare Advantage plan enrollment is projected to grow to 35.7 million people in 2025.

Bradford Health Services Acquires Behavioral Health Provider Lakeview Health. Alabama-based Bradford Health Services, a behavioral health provider that offers addiction treatment and recovery services, announced on September 25, 2024, that it has acquired Lakeview Health. Lakeview Health specializes in gender-specific substance use disorder treatment and eating disorder care, along with other programming. Financial terms of the transaction were not disclosed.

Three Medicare Advantage Plans Received $140 Million in Overpayments, HHS OIG Finds. Modern Healthcare reported on September 26, 2024, that three health insurers collected at least an additional $140 million by misusing diagnosis codes for Medicare Advantage members, according to a report from the Health and Human Services Department Office of Inspector General (HHS OIG). It is estimated that EmblemHealth received approximately $130 million in overpayments in 2015; Humana received at least $13.1 million extra in 2017 and 2018; and Aetna/HealthAssurance received overpayments of $4.2 million in 2018 and 2019. The OIG recommends that Humana and EmblemHealth repay a portion of the allege overpayments, and that HealthAssurance return the full $4.2 million.

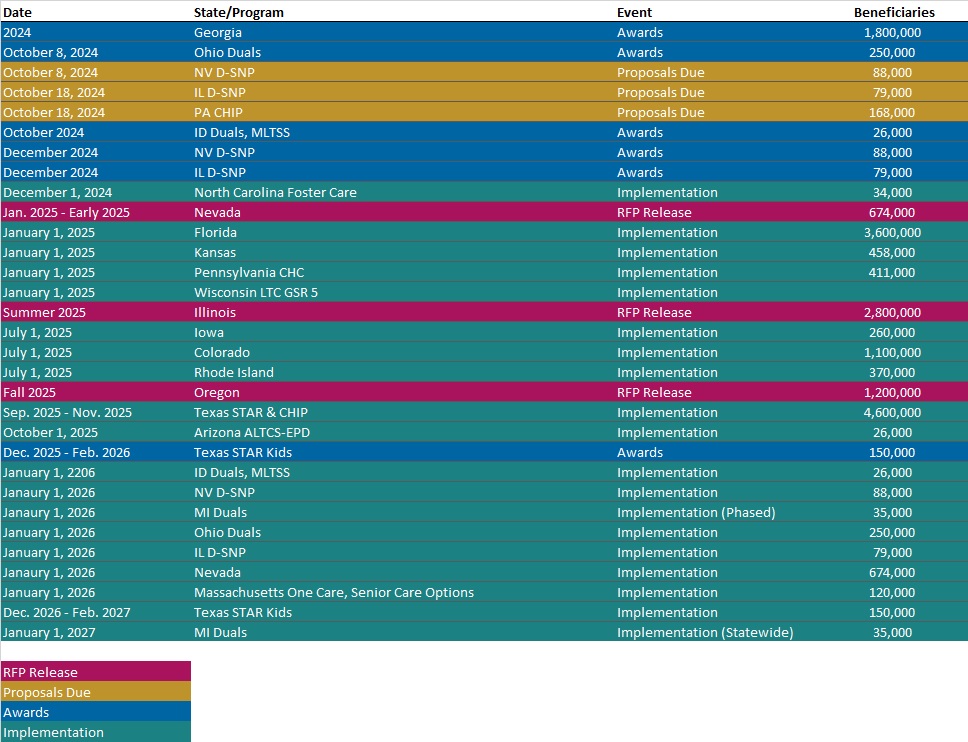

RFP Calendar

HMA News & Events

NEW THIS WEEK ON HMA INFORMATION SERVICES

(Exclusive Access for HMAIS Subscribers):

HMAIS Reports

- HMA Federal Health Policy Quick Takes

- Updated Medicaid Managed Care Rate Certifications Inventory

- Updated Mississippi State Overview

- Updated Rhode Island State Overview

Medicaid Data

Medicaid Enrollment:

- Florida Medicaid Managed Care Enrollment is Down 10.7%, Jun-24 Data

- Minnesota Medicaid Managed Care Enrollment is Down 13.6%, Sep-24 Data

- Missouri Medicaid Managed Care Enrollment is Down 9.7%, Jul-24 Data

- Ohio Medicaid Managed Care Enrollment is Down 1.9%, Feb-24 Data

Public Documents:

Medicaid RFPs, RFIs, and Contracts:

- California Medi-Cal Dental RFP, Award, Proposals, and Evaluation, 2023-24

- Delaware HCBS Services for IDD RFP, Oct-24

- Illinois Dual Eligible Special Needs Plan (D-SNP) RFP and Related Documents, Sep-24

- Massachusetts One Care, Senior Care Options RFR, Awards, and Responses, 2023-24

- Nevada Medicaid Managed Care Housing Supports and Services RFI, Sep-24

Medicaid Program Reports, Data, and Updates:

- Louisiana Medicaid Annual Reports, 2011-22

- New York Medicaid, CHP Quality Strategy Reports, 2023-25

- Michigan Section 1115 Reentry Services Demonstration Documents, 2024

- Ohio Medicaid Managed Care Capitation Rate Certification and Appendices, 2024

- Tennessee D-SNP Contracts, 2024-25

- CMS MLR Monitoring, Reporting, Oversight Toolkit, Sep-24

- CMS Acute Hospital Care at Home Report, Sep-24

- HHS OIG Medicaid Managed Care Maternal Health Access Report, Sep-24

- HHS OIG Medicare, Medicaid OUD Medication Access Report, Sep-24

A subscription to HMA Information Services puts a world of Medicaid information at your fingertips, dramatically simplifying market research for strategic planning in healthcare services. An HMAIS subscription includes:

- State-by-state overviews and analysis of latest data for enrollment, market share, financial performance, utilization metrics and RFPs

- Downloadable ready-to-use charts and graphs

- Excel data packages

- RFP calendar

If you’re interested in becoming an HMAIS subscriber, contact Andrea Maresca at [email protected].