HMA Weekly Roundup

Trends in Health Policy

This week's roundup:

- Countdown to HMA’s Fall 2024 Conference: Spotlight on Medicare-Medicaid Integration

- In Focus: Illinois D-SNP RFP: Highlights and Signals of Forthcoming Trends

- California Announces Intent to Award Medi-Cal Dental Managed Care Contracts in Los Angeles, Sacramento Counties

- Maryland Renews Eight Medicaid MCO Contracts for 2025; Announces Intent to End Contract with Kaiser Permanente

- Minnesota Releases Electronic Visit Verification Implementation Grant Distribution RFP

- Nevada Releases Coordination Only Dual Eligible Special Needs Plan RFP

- Virginia Releases Fiscal Agent Services RFP

- CMS Releases Final Rule Addressing Medicaid Drug Rebate Program

- Black, Latine Family Doctors More Likely to See Medicaid Patients

- Hospital Readmission Penalties Remain Comparable Over Past Three Years

- Cigna to Cut Medicare Advantage Plans Across Eight States in 2025

- More News Here

In Focus

Countdown to HMA’s Fall 2024 Conference: Spotlight on Medicare-Medicaid Integration

The upcoming HMA event, Unlocking Solutions in Medicaid, Medicare, and Marketplace, offers extensive opportunities to engage with leaders from various sectors who are designing and implementing Medicare-Medicaid integration initiatives. Join us for main stage panel discussions with distinguished health plan executives from national and local plans and Medicaid directors from Iowa, New Mexico, New York, and Rhode Island.

HMA Principal Holly Michaels Fisher will lead a deeper dive into integration issues during the breakout session, Innovations to Improve Outcomes for Medicare-Medicaid Dually Eligible Individuals, with speakers Michael Carson, President and CEO of WellCare; Dr. Steven R. Counsell, Medical Director for the Division of Aging at Indiana Family and Social Services Administration; Dr. Linda Kurian, Executive Medical Director for the Center of Excellence of Medicare Duals/D-SNP at Aetna; and Juliet Marsala, Deputy Secretary for the Office of Long-term Living in the Pennsylvania Department of Human Services.

During the breakout, Meeting New Expectations for Health Equity and Improved Beneficiary Outcomes in Medicare Advantage, HMA Principal Greg Gierer, will facilitate a conversation on the evolving landscape of MA rates and supplemental benefits, with experts Melinda Buntin, Health Economist and Bloomberg Distinguished Professor at the Johns Hopkins Bloomberg School of Public Health and the Johns Hopkins Carey Business School; Mark Fendrick, Director of the University of Michigan’s Center for Value-Based Insurance Design, and Matt Kazan, Vice President of Policy and Government Affairs at the SCAN Group.

Online registration ends October 1st.

Illinois D-SNP RFP: Highlights and Signals of Forthcoming Trends

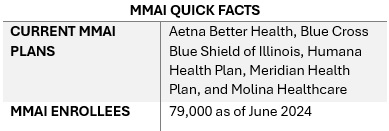

This week, our In Focus section highlights the Illinois Department of Healthcare and Family Services request for proposals (RFP) for a dual-eligible special needs plan (D-SNP) to replace its current Medicare-Medicaid Alignment Initiative (MMAI) demonstration.

Overview

Illinois is one of the states affected by the Centers for Medicare & Medicaid Services (CMS) decision to end the capitated model in the federal Financial Alignment Initiative (FAI) demonstration. Illinois is among the last states to issue an RFP that will support the transition from the demonstration program. Two states, Texas and South Carolina, have yet to issue RFPs. On September 10, 2024, CMS issued a memo discussing end-of-demonstration enrollment and operational considerations and deadlines by which states should make operational decisions.

The Health Management Associates, Inc., (HMA) In Focus article June 26, 2024, discussed related changes that CMS finalized to the federal policy framework for D-SNPs to enhance care coordination, improve health outcomes, and ensure that dual-eligible beneficiaries receive accurate information about their healthcare while integrating successful features of the FAI demonstration and the Medicare-Medicaid Plan (MMP) program. These decisions are prompting more states to develop new models for integrating Medicare and Medicaid services.

Illinois D-SNP RFP Highlights

This Illinois procurement will transition the state to a fully integrated dual-eligible special needs plan (FIDE-SNP) model, which will include a requirement that plans provide managed long-term services and supports (MLTSS) for both people who are dually eligible and Medicaid-only beneficiaries beginning in 2027.

The RFP is largely focused on quality care provisions and improved care coordination across all services lines, including overall expectations to achieve the following:

- Improved access and quality of community-based behavioral health services

- Better quality of care in facilities

- Fewer program opt-outs

- A strategy for increasing the use of alternative payment models (APMs) in Medicaid managed care in Illinois, particularly for behavioral health providers

Emerging National Trends

Overall, the Illinois D-SNP procurement reflects broader national trends toward more coordinated, equitable, and outcome-focused healthcare.

Focus on Health Equity. The procurement emphasizes health equity and reducing disparities, including information on innovations that are responsive to health-related social needs (HRSNs) and social determinants of health (SDOH). The state is weighing payers’ experience partnering with non-traditional providers to meet Medicaid customers’ needs, their innovative programs to address customers who are difficult to locate, and their strategies for improving care for adults with complex needs in facility or community-based settings.

In addition, the state will require plans to report outcomes by race, ethnicity, and geography. Given the demographic and health equity reporting requirements, payers should be prepared to speak to their data collection, member engagement strategies, and relationships with community-based organizations. This capability will be an essential component of addressing both population health and health equity activities.

Alternative Payment Models. The RFP also requests detailed information on the payer’s strategy for increasing the use of APMs in Illinois Medicaid managed care, including the models the payer intends to implement. Experience supported by data-driven outcomes and explanations of work with providers or clinics to adopt, manage, and support reporting and analytics for APMs is a key area of interest for the state. Notably, the state seeks information on plans to include behavioral health providers in APMs.

Long-Term Services Related Transitions. The RFP questions also reflect the long-term services and supports that dually eligible beneficiaries need, as well as those of Medicaid-only beneficiaries who are eligible for these services. More specifically, the RFP raises questions to determine how payers will effectively implement nursing home diversion plans, incentivize hospitals to discharge patients to community settings, and approaches to transition members from institutional settings to the home and community, including by connecting members with supports for HRSNs. Payers will be expected to provide specific examples of their experience and outcomes in other states.

Emerging National Trends

The emphasis on health equity in the Illinois RFP reflects a broader national trend. States are increasingly interested in—and in some situations required—addressing SDOH and reduce disparities, especially for the Medicare and Medicaid dual-eligible population. As a result, payers and other healthcare organizations must develop capacity internally and through external collaborations to build their expertise and evidence base for advancing improvements.

The push for APMs in the Illinois procurement aligns with national efforts to move away from fee-for-service models. Illinois’s inclusion of behavioral health providers in APMs and requiring integrated care models highlights the growing recognition of the importance of mental health in overall health outcomes.

Illinois’s RFP also reflects heightened interest in improving care transitions and coordination. The potential for incentive programs related to community placement and increased focus on nursing home diversion will require innovative plans and a long-term commitment to working with all stakeholders to build on the federal FAI experiences.

What We’re Watching

Responses to the Illinois RFP are due October 18, 2024, and awards are expected to be announced in December. The state anticipates making awards to the top four bidders. Contract execution is estimated July 2025, with implementation January 1, 2026.

As the FAI demonstration ends and CMS’s integration requirements take effect over the next several years, there will be a steep learning curve for states, payers, and other key stakeholders adapting to this evolving environment. Compliance with new CMS rules will be crucial, and experiences in Illinois and other FAI demonstration states can provide valuable insights for other states and stakeholders.

Additional growth and program refinements in the federal Medicare Advantage (MA) landscape are expected in the coming years, especially among MA D-SNPs. Those MA D-SNPs that have yet to participate in Medicaid will need to continue make significant business decisions on participation and actively compete to secure state Medicaid contracts, which will have downstream implications for their state and local partners.

Connect with Us

Health Management Associates (HMA) experts continue to review the evolving landscape and federal changes that will affect D-SNPs in 2025 and beyond. Contact HMA experts Julie Faulhaber, Holly Michaels Fischer, Greg Gierer, Dara Smith, and Tim Murray for details about the nationwide D-SNP rules and landscape.

HMA Roundup

California

California Announces Intent to Award Medi-Cal Dental Managed Care Contracts in Los Angeles, Sacramento Counties. The California Department of Health Care Services released on September 20, 2024, a notice of intent to award its Medi-Cal dental managed care contracts in Los Angeles and Sacramento counties to DentaQuest/California Dental Network and incumbents Liberty Dental and Centene/Health Net Community Solutions. The contract is expected to begin July 1, 2025. Incumbent Avesis/Access Dental did not receive an award.

California Legislature Passes Stricter PBM Regulation Bill. Modern Healthcare reported on September 24, 2024, that California may join 25 other states in enacting stricter regulation over pharmacy benefit managers (PBMs) through Senate Bill 966, sponsored by Sen. Scott Wiener (D-San Francisco). The bill would require PBMs to apply for a license by 2027, require all licensed PBMs to give all the pharmaceutical manufacturers’ rebates they receive to health plans or insurers, and mostly prohibit PBMs from directing patients to pharmacies they own. The bill passed the full legislature in August, and Governor Gavin Newsom has until September 30 to sign it into law.

Florida

Florida Faces Federal Lawsuit Over Lack of Oversight of HCBS. Health News Florida reported on September 25, 2024, that attorneys representing Floridians with disabilities have filed a federal lawsuit against the Agency for Health Care Administration (AHCA) over its oversight practices of Medicaid managed care organizations (MCOs) that provide home and community-based services (HCBS) to people who require long-term care. The lawsuit alleges that MCOs do not provide enough information regarding their decisions to deny or reduce services and that AHCA does not hold plans accountable in their hearing process to review MCO decisions. The lawsuit also seeks an injunction to require AHCA to ensure MCOs provide adequate notice before a denial, reduction, or termination of services to prevent plans from placing arbitrary limits on services, and to ensure AHCA’s hearing process meaningfully reviews MCOs’ decision-making.

Florida Required to Submit Eight Outstanding Medicaid Reports to CMS. Florida Phoenix reported on September 20, 2024, that the Florida Agency for Health Care Administration (AHCA) has eight missing Medicaid reports for its Florida Managed Medical Assistance Section 1115 demonstration. The Centers for Medicare & Medicaid Services (CMS) and AHCA have agreed to a schedule for the agency to submit the outstanding documents, which CMS outlined in an official letter to AHCA. The agency has until December 31, 2024, to submit all missing documents, and must submit at least one document per month until the final deadline, with the first due by September 30. If AHCA does not comply, the state will be placed on a corrective action plan (CAP).

Florida EVV System with HHAeXchange Begins October 1. The Florida Agency for Health Care Administration announced that Florida will transition to a new home health services electronic visit verification (EVV) system through its new contract with HHAeXchange, beginning October 1. The new EVV system is for fee-for-service providers and will verify the type of service performed; the date, time, and location of the service; and the provider and recipient of the service.

Maryland

Maryland Renews Eight Medicaid MCO Contracts for 2025; Ends Contract with Kaiser Permanente. WYPR reported on September 20, 2024, that the Maryland Department of Health (MDH) has renewed contracts with eight incumbent Medicaid managed care organizations (MCOs): CVS/Aetna, Elevance/Wellpoint, UnitedHealthcare, Priority Partners/Johns Hopkins, Maryland Physicians Care, MedStar Family Choice, CareFirst Blue Cross Blue Shield/University of Maryland Health Partners, and JAI Medical Systems. MDH will not renew its contract with Kaiser Permanente, whose 109,000 beneficiaries will transition to other health plans. The agency will also impose new staffing requirements on MCOs in 2025 to ensure quality, oversight, and equity. Maryland does not have a competitive procurement process for Medicaid managed care.

Kaiser Permanente Requests to Continue Negotiations with Maryland After Contract Renewal Decisions. Health Payer Specialist reported on September 25, 2024, that Kaiser Permanente has requested to continue negotiations with the Maryland Department of Health (MDH) after the state chose not to renew its contract with the Medicaid managed care organization (MCO) for 2025. MDH is imposing new staffing and reporting requirements on MCOs in 2025, but Kaiser’s care model reports care and services differently, so the plan is negotiating with MDH to propose ways to apply the new requirements to its model.

Michigan

Michigan to Grant $9.1 Million to Reduce Health Disparities through Healthy Community Zones. The Michigan Department of Health and Human Services (MDHHS) announced on September 25, 2024, that it will be awarding $9.1 million in funding for organizations to develop Healthy Community Zones in Chippewa and Saginaw counties and Detroit, which aim to decrease racial disparities in health outcomes. The state anticipates awarding 30 organizations, with individual agency awards of up to $500,000 and minimum awards of $50,000. The program is anticipated to begin April 2025 and end September 2026. Funding, which will be open to local organizations, will need to support increasing food security, creating active communities and healthy built environments, and enhancing social cohesion. A pre-application webinar will be held on October 7.

Minnesota

Minnesota Releases Electronic Visit Verification Implementation Grant Distribution RFP. The Minnesota Department of Health and Human Services released on September 20, 2024, a request for proposals (RFP) seeking a vendor to distribute grants to assist personal care service and home care service providers with a portion of the costs incurred from the second phase of implementation of the electronic visit verification platform. The selected vendor will manage applications for grants, determine eligibility, and distribute up to $864,000 in grant funds. The contract term is expected to run from November 1, 2024, through June 30, 2027, with no option years. Proposals are due by October 11.

Mississippi

Mississippi Receives Federal Approval to Extend Healthier Mississippi Demonstration. The Centers for Medicare & Medicaid Services (CMS) announced on September 24, 2024, that it has approved a five-year extension of Mississippi’s Section 1115 Healthier Mississippi demonstration through September 30, 2029. The demonstration, which includes no changes, offers Medicaid coverage of primary and preventative care to aged, blind, or disabled individuals who are not enrolled in Medicare or otherwise eligible for Medicaid.

Nevada

Nevada Releases Coordination Only Dual Eligible Special Needs Plan RFP. The Nevada Department of Health and Human Services (DHHS) released on September 11, 2024, a request for proposals (RFP) soliciting bids from Medicare Advantage (MA) plans to serve as a Coordination Only Dual Eligible Special Needs Plan (CO D-SNP). The state intends to award up to five MA plans. This procurement will expand the CO D-SNP eligible population to include Specified Low-income Medicare Beneficiary and Specified Low-income Medicare Beneficiary Plus. Proposals are due by October 8, with notice of awards anticipated in December. Contracts are set to go live on January 1, 2026, for a five-year term through December 31, 2030, with two optional extension years. CO D-SNPs are not responsible for coverage or reimbursement of Medicaid services. Nevada serves approximately 88,000 dual eligible members.

New York

New York Fails to Meet Oversight Standards for Supportive Housing Providers. Crain’s New York reported on September 18, 2024, that New York supportive housing providers under supervision of the state Office of Temporary and Disability Assistance (OTDA) failed to meet basic contract requirements, potentially risking resident safety and long-term success, according to an audit by Comptroller Thomas DiNapoli. The report found OTDA, which had 159 contracts between 2016 and 2022, completed required monitoring visits in fewer than half of its active supportive housing projects. Roughly half of the residents sampled did not have individualized service plans and 10 percent lacked evidence of adequate case management.

Virginia

Virginia Releases Fiscal Agent Services RFP. The Virginia Department of Medical Assistance Services (DMAS) released on September 19, 2024, a request for proposals (RFP) seeking a contractor to operate its Fiscal Agent Services (FAS) and call center services. The FAS contractor will replace legacy FAS services and transform business processes by using technological advancements such as artificial intelligence, progressive web apps, database platforms, low code application development, application programming interface, and natural language processing and machine learning technology. Proposals are due December 20, and contracts will run for six years, with three 24-month renewal options.

National

CMS Releases Final Rule Addressing Medicaid Drug Rebate Program. The Centers for Medicare & Medicaid Services (CMS) released on September 20, 2024, a final rule to address misclassification and incorrect reporting by manufacturers of drug products information in the Medicaid Drug Rebate Program (MDRP). The rule is intended to ensure that states can obtain the required manufacturer rebates, and explains the processes, timelines and penalties associated with late and incorrect reporting and failure of drug manufactures to correct information. As a result, CMS expects states will improve operations of their pharmacy programs and enhance access to necessary prescription medications. The final rule also finalizes policies to address pharmacy benefit operations in Medicaid managed care, some of which which affect pharmacy benefit managers (PBMs).

CMS Requires States to Outline Medicaid Unwinding Compliance by December 31. Modern Healthcare reported on September 20, 2024, that the Centers for Medicare & Medicaid Services (CMS) is requiring all states to submit information detailing the scope of their compliance with Medicaid unwinding renewal requirements and their plans to correct any deficiencies by December 31, 2024. States that are working to correct areas of noncompliance will need to provide a written update every six months, and all states will need to be fully compliant with renewal policies by December 31, 2026. States that are not meeting milestones for their compliance plans or are at risk of missing the 2026 compliance deadline could be subject to additional information requests and more frequent reporting of their progress.

CMS Awards $9 Million in Grant Funding to Improve Women’s Health Coverage. The Centers for Medicare & Medicaid Services (CMS) announced on September 20, 2024, that it has awarded nearly $9 million in grant funding for states to improve women’s health coverage and access to critical health benefits, with a focus on improving access to reproductive health care and maternal health outcomes. The Expanding Access to Women’s Health program grantees include the District of Columbia, Arkansas, Colorado, Hawaii, Massachusetts, Maine, Mississippi, Nebraska, New Hampshire, New Jersey, New Mexico, Pennsylvania, Vermont, Washington, and Wisconsin. Each awardee will be required to develop and submit a work plan outlining specific milestones for successful implementation across the two-year grant period.

Remote Patient Monitoring in Medicare Lacks Transparency, HHS OIG Finds. Modern Healthcare reported on September 24, 2024, that about 43 percent of patients enrolled in a remote patient monitoring program did not receive the full range of services, according to a report from the U.S. Department of Health and Human Services Office of the Inspector General (HHS OIG). The report also noted instances of companies signing up patients who did not need remote monitoring, with Medicare payments for remote monitoring totaling $311 million in 2022, up from $15 million in 2019. The OIG has recommended that the Centers for Medicare & Medicaid Services strengthen oversight of remote patient monitoring by implementing additional safeguards for Medicare billing, conducting provider education about billing of remote patient monitoring, and identifying and monitoring companies that bill for remote patient monitoring.

Hospital Readmission Penalties Remain Comparable Over Past Three Years. Modern Healthcare reported on September 23, 2024, that the proportion of hospitals facing penalties of 1 percent or more on their Medicare payments due to readmission rates has remained relatively stable over the past three years, according to preliminary 2025 claims data from July 2020 through June 2023. In fiscal 2025, 7 percent of hospitals will be charged penalties of 1 percent or more, compared with 7.5 percent in fiscal 2024. Additionally, 21.4 percent of hospitals will not be assessed penalties, compared with 22.4 percent last year. Final 2025 rates will be released October 1.

More Than 25 Million Medicaid Beneficiaries Disenrolled During Redeterminations, KFF Finds. KFF released on September 18, 2024, an analysis which found that over 25 million individuals were disenrolled from Medicaid and over 56 million had their coverage renewed during Medicaid redeterminations through June 2024. Nearly all states have completed redeterminations. Overall, 31 percent of people whose coverage was redetermined were disenrolled, although this varied widely across states. Montana, Utah, Idaho, Oklahoma, and Texas had disenrollment rates of more than 50 percent, while North Carolina, Maine, Oregon, California, and Connecticut had rates under 20 percent. Enrollment among adults is over 20 percent higher than in February 2020, and child enrollment is 5 percent higher.

House, Senate Democrats Seek Permanent Extension of Enhanced Exchange Subsidies. CQ News reported on September 18, 2024, that House and Senate Democrats sent a letter urging leadership to permanently extend enhanced Affordable Care Act (ACA) Exchange plan subsidies, which are set to expire at the end of 2025. If subsidies expire, it is estimated that enrollment in the Marketplaces will drop from 22.8 million in 2025 to 18.9 million in 2026. A permanent extension, however, could increase the budget deficit by $335 billion over the next 10 years.

House Committee Advances Telehealth, Hospital-at-Home Bill; Votes to Appeal CMS Staffing Rule. Modern Healthcare reported on September 18, 2024, that the House Energy and Commerce Committee unanimously advanced the Telehealth Modernization Act of 2024, which would permit telehealth under Medicare for two additional years and extend the Medicare hospital-at-home program for five more years, both of which were pandemic-era policies and expire December 31. The act would also offset the extensions with projected savings on Medicare prescription drug costs, as well as prohibit pharmacy benefit managers (PBMs) from linking compensation to drug list prices, require them to charge flat fees for negotiating prices, and require them to provide extensive data to certain stakeholders. The committee also voted to repeal a Centers for Medicare & Medicaid Services final rule establishing staffing minimums at nursing homes.

Black, Latine Family Doctors More Likely to See Medicaid Patients. Health Day reported on September 24, 2024, that Latine and Black family doctors saw more Medicaid beneficiaries compared to white or Asian doctors, according a study published in the Annals of Family Medicine, which used national claims data from 2016. Doctors who identified as Black had a 60 percent increase in the likelihood of accepting a significant number of Medicaid patients — defined as 150 or more — and Latine doctors had a 40 percent increased likelihood. Researchers also noted that minority doctors are more likely to return to and set up practices in communities of color, where people are more likely to suffer from chronic disease but have had less access to health care.

CMS Releases Memo for States on Dual Demonstration End Considerations. The Centers for Medicare & Medicaid Services (CMS) released on September 10, 2024, a memo outlining end-of-demonstration enrollment and operational considerations for seven states currently transitioning Medicare-Medicaid Plans (MMPs) to integrated dual eligible special needs plans (D-SNPs) starting January 1, 2026. To ensure seamless transitions for existing MMP enrollees, states may choose to remove the six-month moratorium for opt-in enrollment from the three-way contracts for MMPs that offer successor integrated D-SNPs, extending opt-in enrollment through December 1, 2025. The memo also outlines other policy considerations including if states want to elect to stop passive enrollment into the MMPs sooner than July 1, 2025; and whether states want to implement a special demonstration transition deeming period. All affected states must notify CMS of their decisions regarding end-of-demonstration enrollment by December 31, 2024.

Industry News

Cigna to Cut Medicare Advantage Plans Across Eight States in 2025. Health Payer Specialist reported on September 20, 2024, that Cigna will stop operating 36 Medicare Advantage (MA) plans across eight states in 2025, which will affect at least 5,395 members. The states are Colorado, Florida, Illinois, Missouri, North Carolina, Tennessee, Texas, and Utah. Statewide in Florida, Cigna will no longer offer PPO MA plans, but will still offer HMOs. In each of the affected counties, Cigna will still offer at least one MA plan with a different network.

Individual Marketplace Rates to Increase 7.1 Percent in 2025. Health Payer Specialist reported on September 23, 2024, that the national average rate increase for the individual Marketplace will be 7.1 percent in 2025, according to an analysis by the investment bank Stephens. Cigna and CVS/Aetna will have the highest rate increases, with Cigna’s increase at 13.8 percent and Aetna’s at 12.8 percent.

CareSource Announces Leadership Transitions in Midwest. CareSource announced on September 17, 2024, that it has promoted Steve Smitherman to regional vice president of the Midwest and Dr. Cameual Wright to market president for Indiana. Smitherman previously served as president of CareSource’s Indiana market. Wright was CareSource Indiana’s chief medical officer.

RFP Calendar

Company Announcements

MCG White Paper:

Prostate Cancer: Risk Stratification and Evolving Treatment Options. MCG Associate VP & Managing Editor, William Rifkin, MD, has published a new white paper exploring the importance of risk stratification in prostate cancer treatment, the role of patient life expectancy, and the latest treatment options available (including radical prostatectomy and radiotherapy). Dr. Rifkin also discusses the impact of patient preference and shared decision-making on optimal health outcomes. Download it here.

HMA News & Events

HMA Podcast:

Is Enhancing Quality of Care the Future of Medicaid Innovation? Caprice Knapp, a seasoned health economist with over 20 years of experience in Medicaid and healthcare policy, shares her journey through various roles in government, academia, and private insurance. In this episode, Caprice offers a unique perspective on the challenges of measuring quality in healthcare, the importance of data-driven decision-making, and how global healthcare models can inspire innovation in Medicaid. From pediatric palliative care to cost-effective policy solutions, Caprice sheds light on how improving quality of care can transform healthcare outcomes for vulnerable populations. Listen Here

NEW THIS WEEK ON HMA INFORMATION SERVICES

(Exclusive Access for HMAIS Subscribers):

HMAIS Reports

- Updated Federal Regulatory Tracker

- Updated Medicaid Managed Care Procurement Tracking Report

Medicaid Data

Medicaid Enrollment:

- Arizona Medicaid Managed Care Enrollment is Down 2.1%, Sep-24 Data

- Indiana Medicaid Managed Care Enrollment Is Down 1.4%, Apr-24 Data

- Nevada Medicaid Managed Care Enrollment is Down 12.4%, Jul-24 Data

- Rhode Island Medicaid Managed Care Enrollment is Down 3.5%, 2023 Data

Public Documents:

Medicaid RFPs, RFIs, and Contracts:

- California Medi-Cal Dental RFP and Award, 2023-24

- Michigan Comprehensive Health Care Program Medicaid Model Contract, FY 2024

- Minnesota EVV Implementation Grants Distribution RFP, Sep-24

- Nevada CO D-SNP RFP, Sep-24

- Virginia Fiscal Agent Services RFP, Sep-24

Medicaid Program Reports, Data, and Updates:

- Idaho Medicaid Managed Care Quality Strategy Reports, 2018-24

- Michigan Medicaid Capitation Rate Certification Reports, 2019-25

- Michigan Medicaid Health Plan CAHPS Reports, 2015-24

- Mississippi Healthier Mississippi 1115 Waiver Documents, 2015-24

- Pennsylvania HealthChoices CAHPS Quality Measures, 2020-23

- Rhode Island Medicaid Managed Care Program Annual External Quality Review Technical Reports, 2015-22

A subscription to HMA Information Services puts a world of Medicaid information at your fingertips, dramatically simplifying market research for strategic planning in healthcare services. An HMAIS subscription includes:

- State-by-state overviews and analysis of latest data for enrollment, market share, financial performance, utilization metrics and RFPs

- Downloadable ready-to-use charts and graphs

- Excel data packages

- RFP calendar

If you’re interested in becoming an HMAIS subscriber, contact Andrea Maresca at [email protected].